Question: will rate! please make sure it's right ad the requirements. i Requirements 1. Determine the amounts that MusicYear should report for cost of goods sold

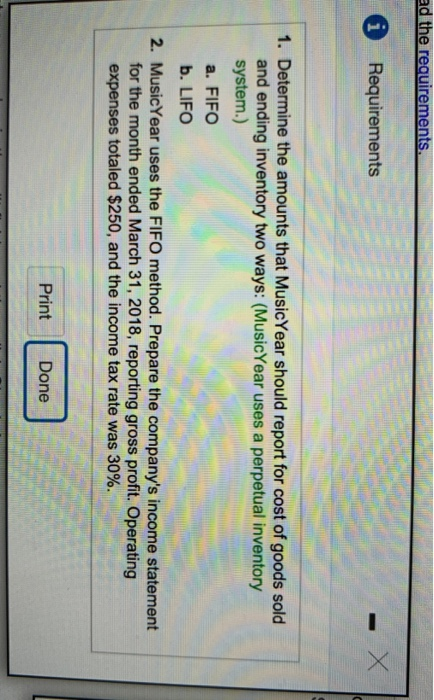

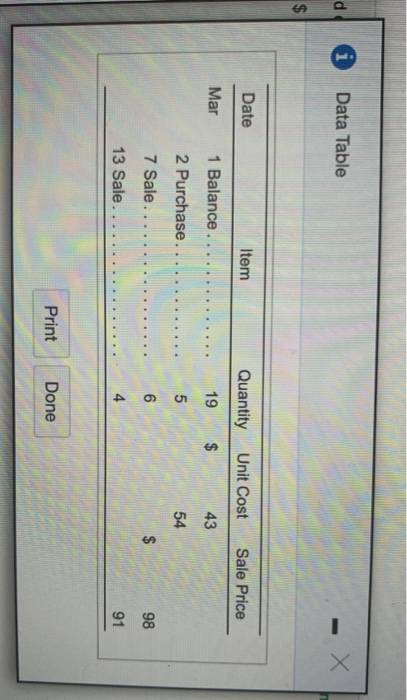

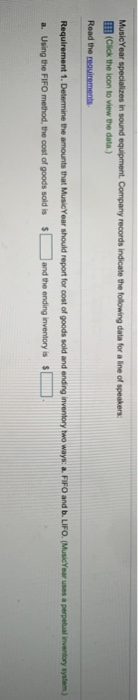

ad the requirements. i Requirements 1. Determine the amounts that MusicYear should report for cost of goods sold and ending inventory two ways: (MusicYear uses a perpetual inventory system.) a. FIFO b. LIFO 2. MusicYear uses the FIFO method. Prepare the company's income statement for the month ended March 31, 2018, reporting gross profit. Operating expenses totaled $250, and the income tax rate was 30%. Print Done d i Data Table $ Date Item Quantity Unit Cost Sale Price Mar 1 Balance 19 43 2 Purchase... 5 54 6 $ 98 7 Sale.... 13 Sale.... 4 91 Print Done MusicYear specializes in sound equipment Company records indicate the following data for a line of speakers (Click the icon to view the data) Read the requirements Requirement 1. Determine the amounts that MusicYear should report for cost of goods sold and ending inventory two ways: . FIFO and b. LIFO. (MusicYear uses a perpetual inventory system) a. Using the FIFO method, the cost of goods sold is $ and the ending inventory is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts