Question: WILL RATE! PLEASE SHOW HOW ANSWER IS ACHEIVED. Contribution Margin Analysis Costello Industries Inc. manufactures only one product. For the year ended December 31, the

WILL RATE! PLEASE SHOW HOW ANSWER IS ACHEIVED.

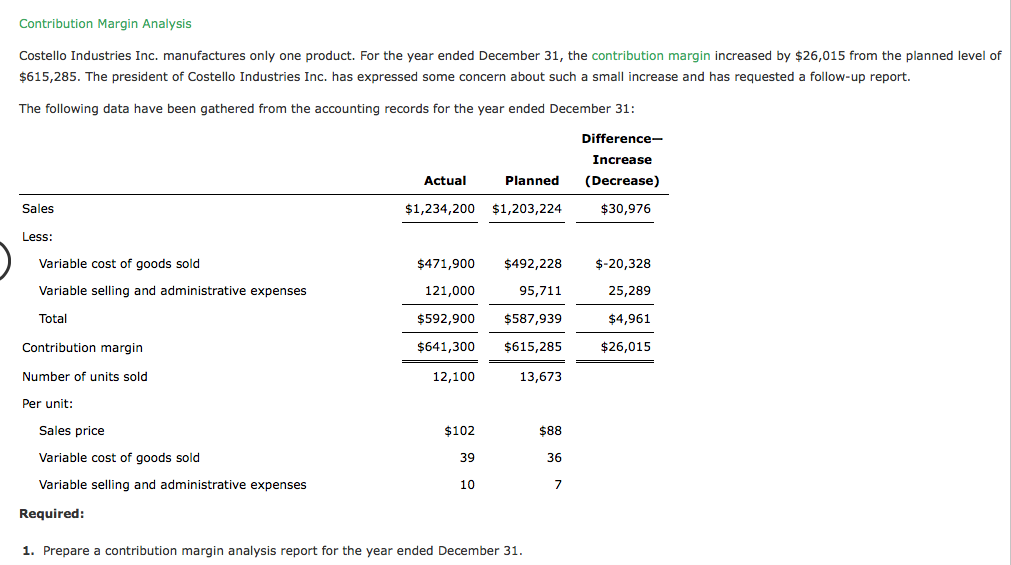

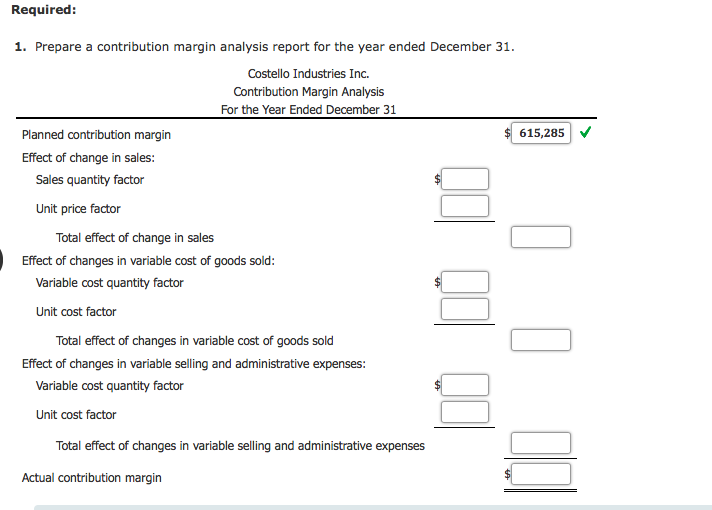

Contribution Margin Analysis Costello Industries Inc. manufactures only one product. For the year ended December 31, the contribution margin increased by $26,015 from the planned level of small increase and has requested a follow-up $615,285. The president of Costello Industries Inc. has expressed some concern about such a report The following data have been gathered from the accounting records for the year ended December 31: Difference Increase Actual Planned (Decrease) Sales $1,234,200 $1,203,224 $30,976 Less Variable cost of goods sold $471,900 $492,228 20,3 Variable selling and administrative expenses 121,000 25,289 95,71 Total $592,900 $587,939 $4,961 $641,300 $615,285 26,015 Contribution margin Number of units sold 12,100 13,673 Per unit $102 Sales price $88 Variable cost of goods sold 39 36 Variable selling and administrative expenses 10 Required: 1. Prepare a contribution margin analysis report for the year ended December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts