Question: will rate! thanks! Problem 3-18 Common-Size and Common-Base Year Financial Statements In addition to common-size financial statements, common-base year financial statements are often used. Common-base

will rate! thanks!

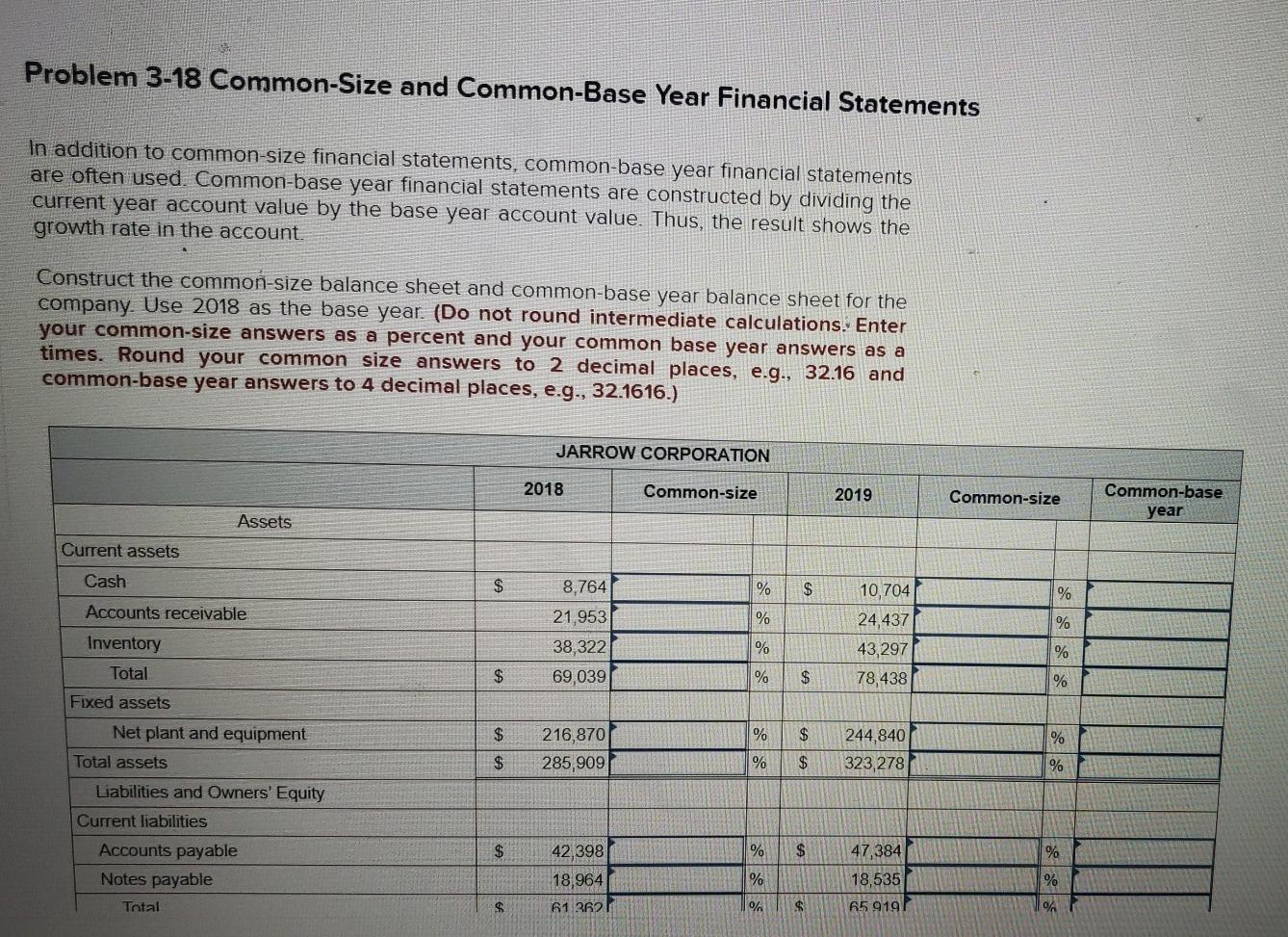

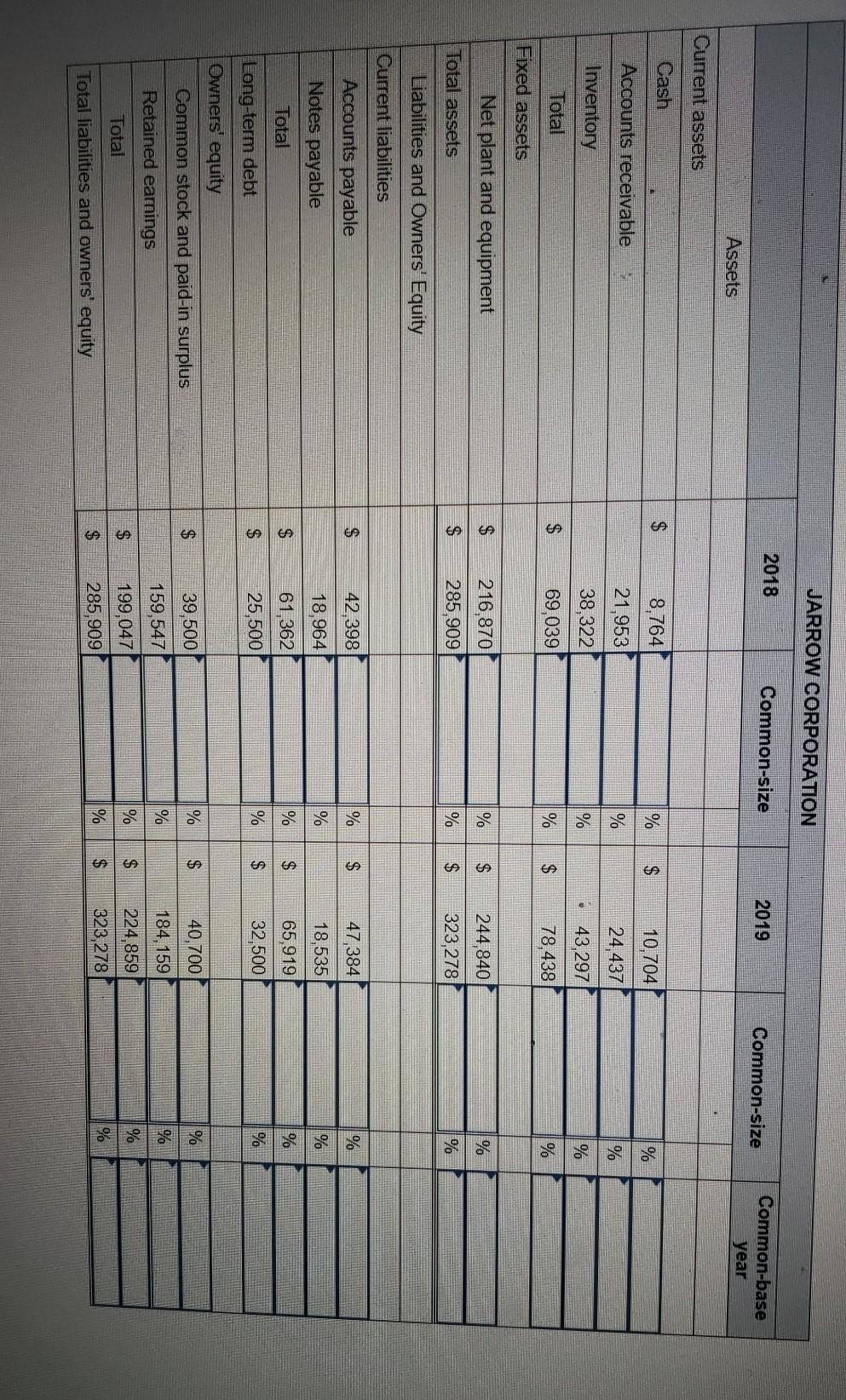

Problem 3-18 Common-Size and Common-Base Year Financial Statements In addition to common-size financial statements, common-base year financial statements are often used. Common-base year financial statements are constructed by dividing the current year account value by the base year account value. Thus, the result shows the growth rate in the account Construct the common-size balance sheet and common-base year balance sheet for the company. Use 2018 as the base year. (Do not round intermediate calculations. Enter your common-size answers as a percent and your common base year answers as a times. Round your common size answers to 2 decimal places, e.g., 32.16 and common-base year answers to 4 decimal places, e.g., 32.1616.) JARROW CORPORATION 2018 Common-size 2019 Common-size Common-base year Assets Current assets Cash $ 8,764 % $ % Accounts receivable % % 21,953 38,322 69,039 Inventory Total 10,704 24,437 43,297 78,438 % % $ % $ % Fixed assets $ % $ 216,870 285,909 244,840 323,278 % % $ % $ Net plant and equipment Total assets Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total $ % $ % 42 398 18,964 % 47,384 18,535 65 9191 % % $ 61 3621 % 91 $ JARROW CORPORATION 2018 Common-size 2019 Common-size Common-base year Assets Current assets Cash 8,764 % $ % Accounts receivable 21,953 % % Inventory Total 10,704 24,437 43,297 78,438 % % 38,322 69,039 $ % $ % Fixed assets $ % $ 244,840 % Net plant and equipment Total assets Liabilities and Owners' Equity 216,870 285,909 $ % $ 323, 278 Current liabilities % $ % % % 42,398 18,964 61,362 25,500 47,384 18,535 65,919 32,500 . $ % $ % ] Accounts payable Notes payable Total Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings | $ % $ % % $ % $ % % 39,500 159,547 199,047 285,909 40,700 184, 159 224,859 323,278 % $ % $ Total % $ % Total liabilities and owners' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts