Question: will rate the answer (4) Discuss one modification you could make to Question 3 vourself to determine if your linal answet is directionally correct and/or

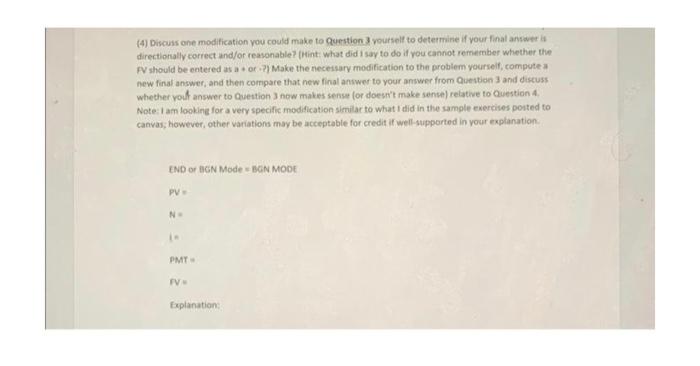

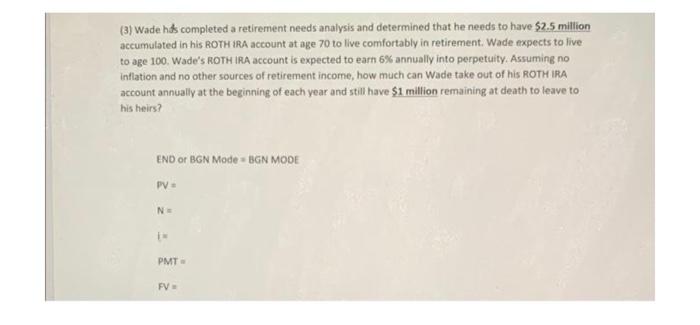

(4) Discuss one modification you could make to Question 3 vourself to determine if your linal answet is directionally correct and/or ceasonable? (Mint: What did 1 say to do if you cannot remember whether the F should be entered as a + or - ?) Make the necessary modification to the problem yourself, compute a new final answer, and then compare that new final anwwer to your answer from Question 3 and discuss whether youf answer to Quettion 3 now makes sense (or doest't make sense) relative to Question 4. Note: 1 am looking for a very specific modification similar to what 1 did in the sample exercises poited to canyas; however, other variations may be acceptable for credit if well-stipported in your explanation: (3) Wade hds completed a retirement needs analysis and determined that he needs to have $2.5 million accumulated in his ROTH iRA account at age 70 to live comfortably in retirement. Wade expects to live to age 100 . Wade's ROTH IRA account is expected to earn 6% annually into perpetuity. Assuming no inflation and no other sources of retirement income, how much can Wade take out of his ROTH IRA account annually at the beginning of each year and still have $1 million remaining at death to leave to his heirs? (4) Discuss one modification you could make to Question 3 vourself to determine if your linal answet is directionally correct and/or ceasonable? (Mint: What did 1 say to do if you cannot remember whether the F should be entered as a + or - ?) Make the necessary modification to the problem yourself, compute a new final answer, and then compare that new final anwwer to your answer from Question 3 and discuss whether youf answer to Quettion 3 now makes sense (or doest't make sense) relative to Question 4. Note: 1 am looking for a very specific modification similar to what 1 did in the sample exercises poited to canyas; however, other variations may be acceptable for credit if well-stipported in your explanation: (3) Wade hds completed a retirement needs analysis and determined that he needs to have $2.5 million accumulated in his ROTH iRA account at age 70 to live comfortably in retirement. Wade expects to live to age 100 . Wade's ROTH IRA account is expected to earn 6% annually into perpetuity. Assuming no inflation and no other sources of retirement income, how much can Wade take out of his ROTH IRA account annually at the beginning of each year and still have $1 million remaining at death to leave to his heirs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts