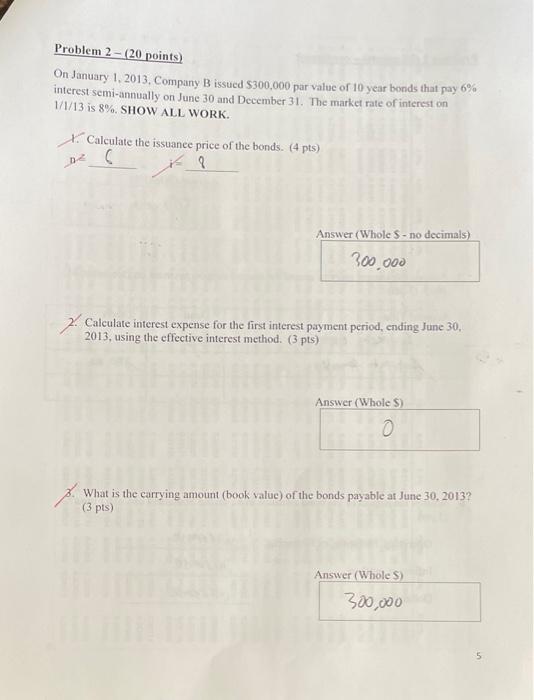

Question: will rate. very confused with this question Problem 2 - (20 points) On January 1, 2013, Company B issued $300,000 par value of 10 year

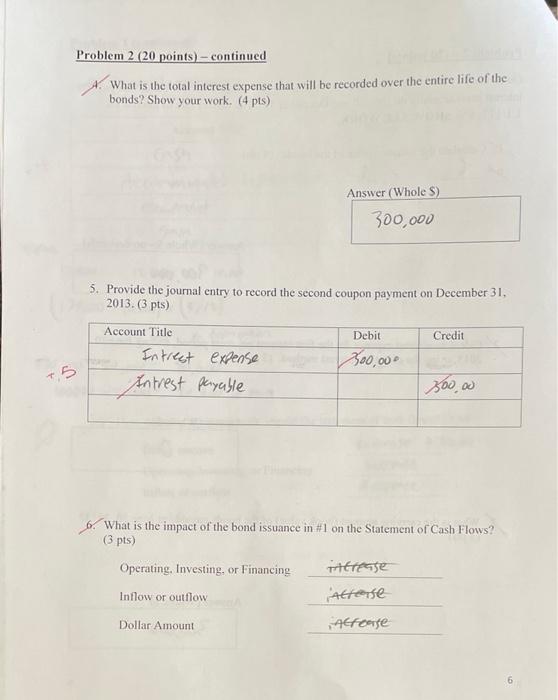

Problem 2 - (20 points) On January 1, 2013, Company B issued $300,000 par value of 10 year bonds that pay 6% interest semi-annually on June 30 and December 31. The market rate of interest on 1/1/13 is 8%, SHOW ALL WORK Calculate the issuance price of the bonds. (4 pts) C 9 D Answer (Whole $ - no decimals) 300.000 7. Calculate interest expense for the first interest payment period, ending June 30, 2013, using the effective interest method. (3 pts) Answer (Whole S) What is the carrying amount (book value) of the bonds payable at June 30, 2013? (3 pts) Answer (Wholes) 300,000 Problem 2 (20 points) - continued What is the total interest expense that will be recorded over the entire life of the bonds? Show your work. (4 pts) Answer (Whole S) 300,000 5. Provide the journal entry to record the second coupon payment on December 31, 2013. (3 pts) Account Title Debit Credit Intrest expense 300.00 300.00 Intrest penyable 6. What is the impact of the bond issuance in #1 on the Statement of Cash Flows? (3 pts) Operating. Investing, or Financing Herease Inflow or outflow Allarse Dollar Amount increase 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts