Question: WILL RATE VERY HIGHLY!! NEED HELP EMERGENCY! 012 not submitted Attempts Remaining Infinity Over the past six months, Six Flags conducted a marketing study on

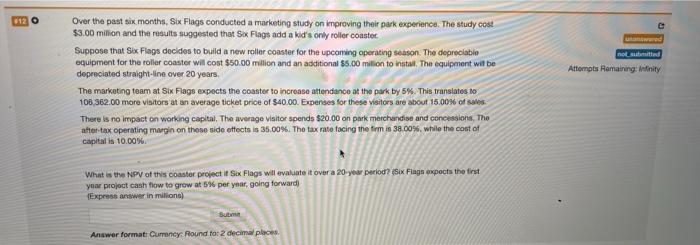

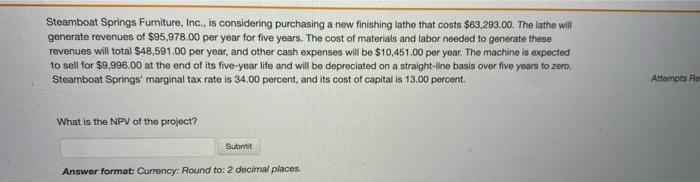

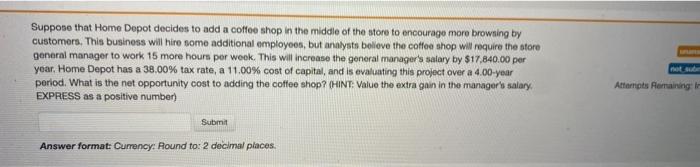

012 not submitted Attempts Remaining Infinity Over the past six months, Six Flags conducted a marketing study on improving their park experience. The study cost $3.00 million and the results suggested that Sox Flags add a kid's only roller coaster Suppose that Six Flags decides to build a new roller coaster for the upcoming operating season. The depreciablo equipment for the roller coaster will cost $50.00 million and an additional $5.00 milion to install. The equipment will be depreciated straight-line over 20 years The marketing team at Six Flags expects the coaster to increase attendance at the park by 5%. This translates to 108 362.00 more visitors at an average ticket price of $40,00. Expenses for these visitors are about 15.00% of sales There is no impact on working capital. The average visitor spends $20.00 on park merchandise and concessions. The after-tax operating margin on these side effects is 35.00%. The tax rate facing the firm in 38.00%, while the cost of capital is 10.00% What is the NPV of this coaster project Six Flags will evaluate it over a 20-year period? (Six Flags expects the first your project cash flow to grow at per year, going forward) Express answer in milione) Su Answer formats Currency: Round for 2 decimal places Steamboat Springs Furniture, Inc., is considering purchasing a new finishing lathe that costs $63,293.00. The lathe will generate revenues of $95,978.00 per year for five years. The cost of materials and labor needed to generate these revenues will total $48,591.00 per year, and other cash expenses will be $10,451.00 per year. The machine is expected to sell for $9,996.00 at the end of its five-year life and will be depreciated on a straight-line basis over five years to zero. Steamboat Springs' marginal tax rate is 34.00 percent, and its cost of capital is 13.00 percent. Attempts Re What is the NPV of the project? Submit Answer format: Currency: Round to: 2 decimal places. Suppone that Home Depot decides to add a coffee shop in the middle of the store to encourage more browsing by customers. This business will hire some additional employees, but analysts believe the coffee shop will require the store general manager to work 15 more hours per week. This will increase the general manager's salary by $17,840.00 per year. Home Depot has a 38.00% tax rate, a 11.00% cost of capital, and is evaluating this project over a 4.00-year period. What is the net opportunity cost to adding the coffee shop? (HINT: Value the extra gain in the manager's salary EXPRESS as a positive number) Attempts Rorairing Submit Answer format: Currency: Round to: 2 decimal places. 012 not submitted Attempts Remaining Infinity Over the past six months, Six Flags conducted a marketing study on improving their park experience. The study cost $3.00 million and the results suggested that Sox Flags add a kid's only roller coaster Suppose that Six Flags decides to build a new roller coaster for the upcoming operating season. The depreciablo equipment for the roller coaster will cost $50.00 million and an additional $5.00 milion to install. The equipment will be depreciated straight-line over 20 years The marketing team at Six Flags expects the coaster to increase attendance at the park by 5%. This translates to 108 362.00 more visitors at an average ticket price of $40,00. Expenses for these visitors are about 15.00% of sales There is no impact on working capital. The average visitor spends $20.00 on park merchandise and concessions. The after-tax operating margin on these side effects is 35.00%. The tax rate facing the firm in 38.00%, while the cost of capital is 10.00% What is the NPV of this coaster project Six Flags will evaluate it over a 20-year period? (Six Flags expects the first your project cash flow to grow at per year, going forward) Express answer in milione) Su Answer formats Currency: Round for 2 decimal places Steamboat Springs Furniture, Inc., is considering purchasing a new finishing lathe that costs $63,293.00. The lathe will generate revenues of $95,978.00 per year for five years. The cost of materials and labor needed to generate these revenues will total $48,591.00 per year, and other cash expenses will be $10,451.00 per year. The machine is expected to sell for $9,996.00 at the end of its five-year life and will be depreciated on a straight-line basis over five years to zero. Steamboat Springs' marginal tax rate is 34.00 percent, and its cost of capital is 13.00 percent. Attempts Re What is the NPV of the project? Submit Answer format: Currency: Round to: 2 decimal places. Suppone that Home Depot decides to add a coffee shop in the middle of the store to encourage more browsing by customers. This business will hire some additional employees, but analysts believe the coffee shop will require the store general manager to work 15 more hours per week. This will increase the general manager's salary by $17,840.00 per year. Home Depot has a 38.00% tax rate, a 11.00% cost of capital, and is evaluating this project over a 4.00-year period. What is the net opportunity cost to adding the coffee shop? (HINT: Value the extra gain in the manager's salary EXPRESS as a positive number) Attempts Rorairing Submit Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts