Question: will someone answer this question this will make the third time ive posted with no response thanks! An investor would like to purchase a new

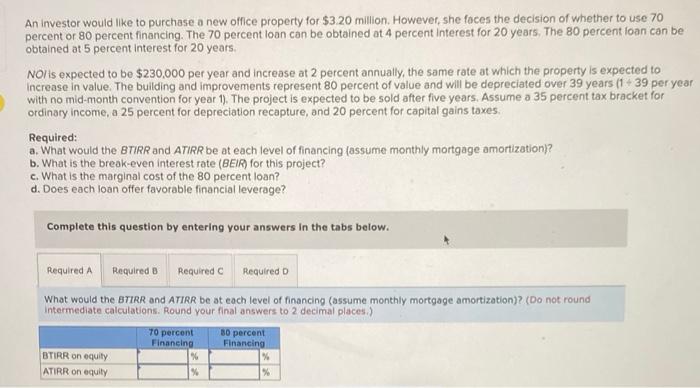

An investor would like to purchase a new office property for $3.20 million. However, she faces the decision of whether to use 70 percent or 80 percent financing. The 70 percent loan can be obtained at 4 percent interest for 20 years. The 80 percent loan can be obtained at 5 percent interest for 20 years. NO/is expected to be $230,000 per year and increase at 2 percent annually, the same rate at which the property is expected to increase in value. The building and improvements represent 80 percent of value and will be depreciated over 39 years (1 39 per year with no mid-month convention for year 1). The project is expected to be sold after five years. Assume a 35 percent tax bracket for ordinary income, a 25 percent for depreciation recapture, and 20 percent for capital gains taxes, Required: a. What would the BTIRR and ATIRR be at each level of financing (assume monthly mortgage amortization)? b. What is the break-even interest rate (BEIR) for this project? c. What is the marginal cost of the 80 percent loan? d. Does each loan offer favorable financial leverage? Complete this question by entering your answers in the tabs below. Required A Required B Required Required What would the BTIRR and ATIRR be at each level of financing (assume monthly mortgage amortization)? (Do not round Intermediate calculations. Round your final answers to 2 decimal places) TO percent 80 percent Financing Financing BTIRR on equity % % ATIRR on equity % % An investor would like to purchase a new office property for $3.20 million. However, she faces the decision of whether to use 70 percent or 80 percent financing. The 70 percent loan can be obtained at 4 percent interest for 20 years. The 80 percent loan can be obtained at 5 percent interest for 20 years. NO/is expected to be $230,000 per year and increase at 2 percent annually, the same rate at which the property is expected to increase in value. The building and improvements represent 80 percent of value and will be depreciated over 39 years (1 39 per year with no mid-month convention for year 1). The project is expected to be sold after five years. Assume a 35 percent tax bracket for ordinary income, a 25 percent for depreciation recapture, and 20 percent for capital gains taxes, Required: a. What would the BTIRR and ATIRR be at each level of financing (assume monthly mortgage amortization)? b. What is the break-even interest rate (BEIR) for this project? c. What is the marginal cost of the 80 percent loan? d. Does each loan offer favorable financial leverage? Complete this question by entering your answers in the tabs below. Required A Required B Required Required What would the BTIRR and ATIRR be at each level of financing (assume monthly mortgage amortization)? (Do not round Intermediate calculations. Round your final answers to 2 decimal places) TO percent 80 percent Financing Financing BTIRR on equity % % ATIRR on equity % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts