Question: will the contribution be deducted in the 2020 return, why or why not. will any be deducted in future returns what code section is involved

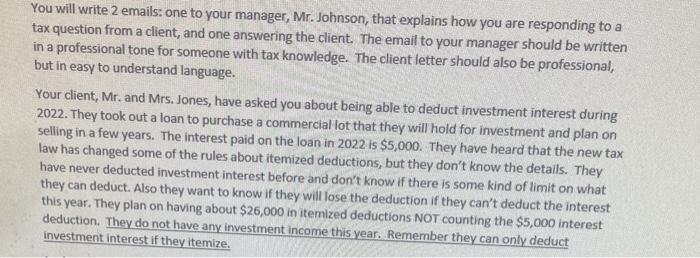

You will write 2 emails: one to your manager, Mr. Johnson, that explains how you are responding to a tax question from a client, and one answering the client. The email to your manager should be written in a professional tone for someone with tax knowledge. The client letter should also be professional, but in easy to understand language. Your client, Mr. and Mrs. Jones, have asked you about being able to deduct investment interest during 2022. They took out a loan to purchase a commercial lot that they will hold for investment and plan on selling in a few years. The interest paid on the loan in 2022 is $5,000. They have heard that the new tax law has changed some of the rules about itemized deductions, but they don't know the details. They have never deducted investment interest before and don't know if there is some kind of limit on what they can deduct. Also they want to know if they will lose the deduction if they can't deduct the interest this year. They plan on having about $26,000 in itemized deductions NOT counting the $5,000 interest deduction. They do not have any investment income this year. Remember they can only deduct investment interest if they itemize

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts