Question: WILL THUMBS IF YOU ARE QUICK 5. 6. 7. 8. Complete the following table. Assume that today is March 31. Stock prices today: Seeger =

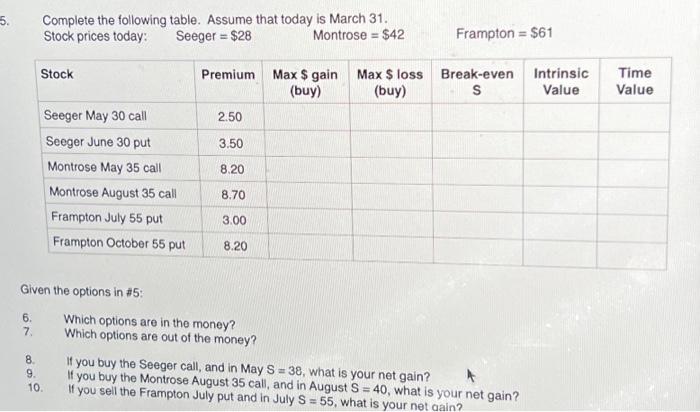

Complete the following table. Assume that today is March 31. Stock prices today: Seeger =$28 Montrose =$42 Frampton =$61 Given the options in $5 : 6. Which options are in the money? 7. Which options are out of the money? 8. If you buy the Seeger call, and in May S=38, what is your net gain? 9. If you buy the Montrose August 35 call, and in August S=40, what is your net gain? 10. If you sell the Frampton July put and in July S=55, what is your net gain? Complete the following table. Assume that today is March 31. Stock prices today: Seeger =$28 Montrose =$42 Frampton =$61 Given the options in $5 : 6. Which options are in the money? 7. Which options are out of the money? 8. If you buy the Seeger call, and in May S=38, what is your net gain? 9. If you buy the Montrose August 35 call, and in August S=40, what is your net gain? 10. If you sell the Frampton July put and in July S=55, what is your net gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts