Question: will thumbs up for quick correct answer Question 7 5 pts Resin Inc. is considering the purchase of new equipment. The new equipment would cost

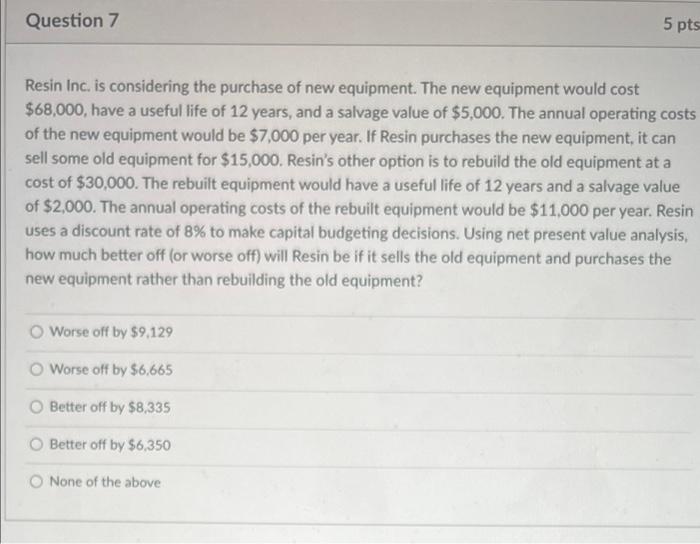

Question 7 5 pts Resin Inc. is considering the purchase of new equipment. The new equipment would cost $68,000, have a useful life of 12 years, and a salvage value of $5,000. The annual operating costs of the new equipment would be $7,000 per year. If Resin purchases the new equipment, it can sell some old equipment for $15,000. Resin's other option is to rebuild the old equipment at a cost of $30,000. The rebuilt equipment would have a useful life of 12 years and a salvage value of $2,000. The annual operating costs of the rebuilt equipment would be $11,000 per year. Resin uses a discount rate of 8% to make capital budgeting decisions. Using net present value analysis, how much better off (or worse off) will Resin be if it sells the old equipment and purchases the new equipment rather than rebuilding the old equipment? a O Worse off by $9.129 Worse off by $6,665 Better off by $8,335 Better off by $6,350 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts