Question: will thumbs up if right A building with a cost of $765,000 has an estimated residual value of $306,000, has an estimated useful life of

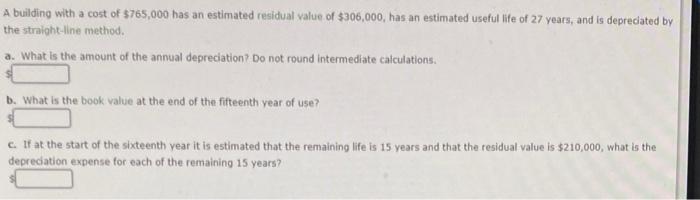

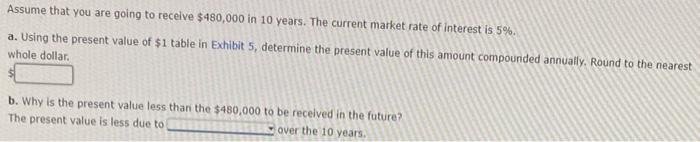

A building with a cost of $765,000 has an estimated residual value of $306,000, has an estimated useful life of 27 years, and is depreciated by the straight-line method. a. What is the amount of the annual depreciation? Do not round intermediate calculations. s b. What is the book value at the end of the fifteenth year of use? 3 c. If at the start of the sixteenth year it is estimated that the remaining life is 15 years and that the residual value is $210, 000 , what is the depreciation expense for each of the remaining 15 years? Assume that you are going to recelve $480,000 in 10 years. The current market rate of interest is 5%. a. Using the present value of $1 table in Exhibit 5, determine the present value of this amount compounded annually. Round to the nearest Whole dollar. 4 b. Why is the present value less than the $480,000 to be received in the future? The present value is less due to over the 10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts