Question: Will thumbs up, please help and show work. Thankyou. Let's say that you found a new asset beta of 1.506. What would the firm's new

Will thumbs up, please help and show work. Thankyou.

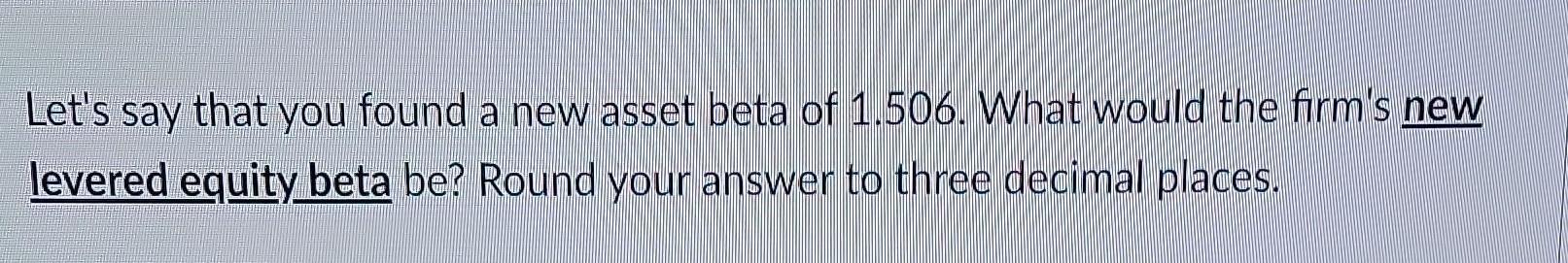

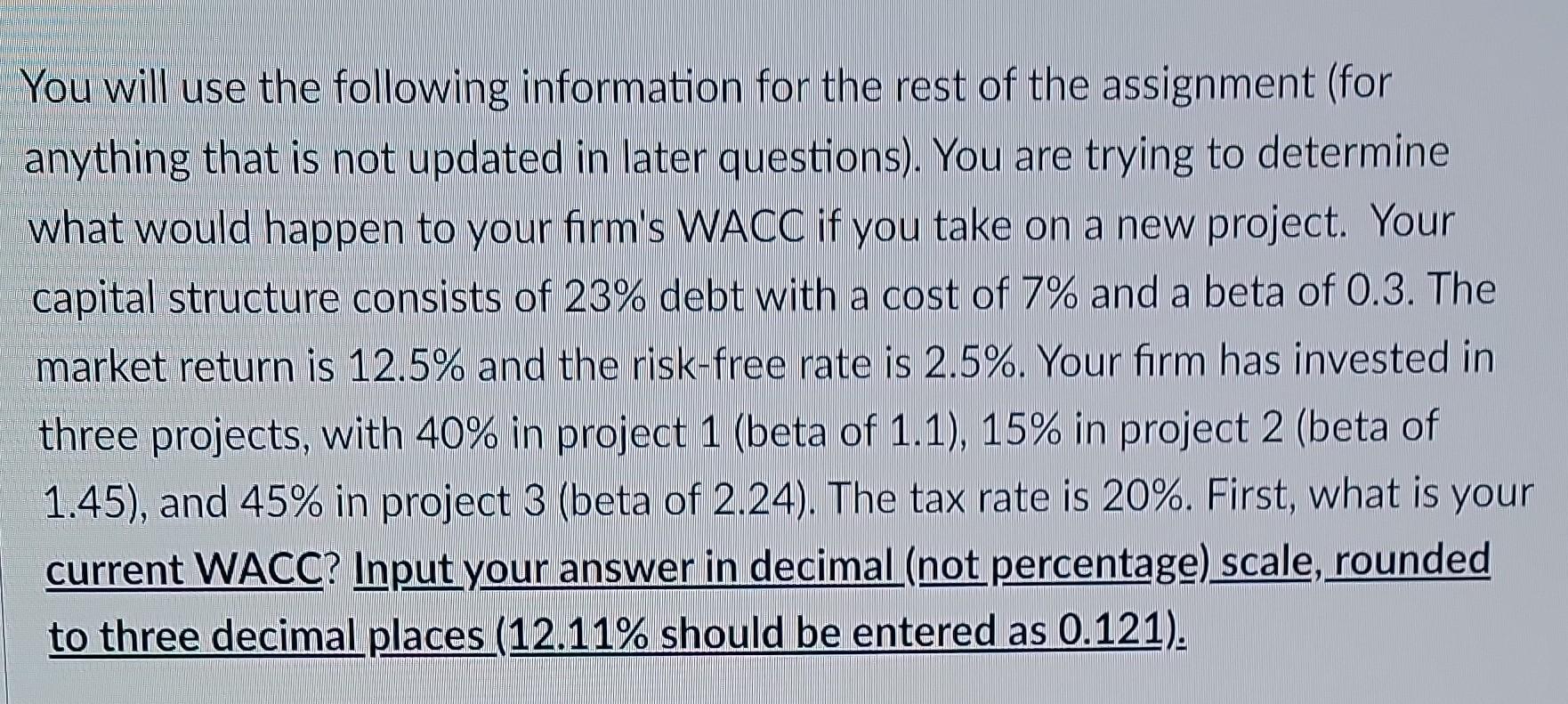

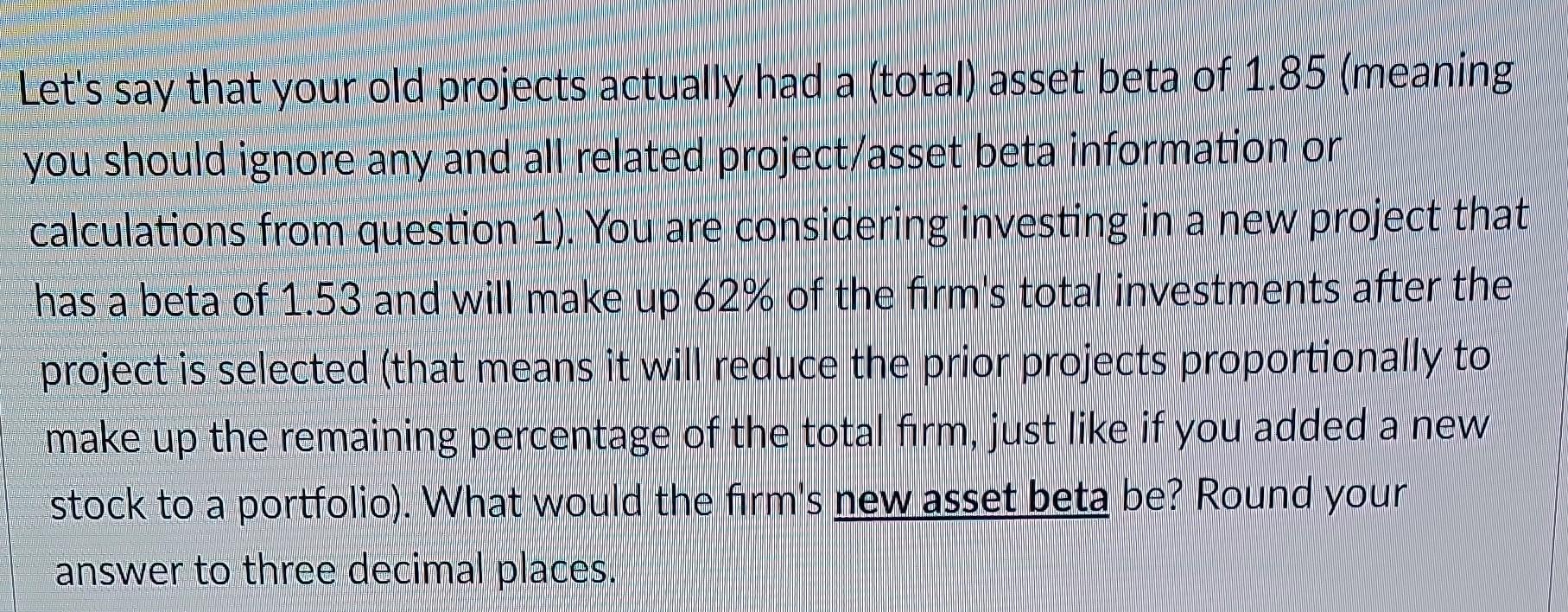

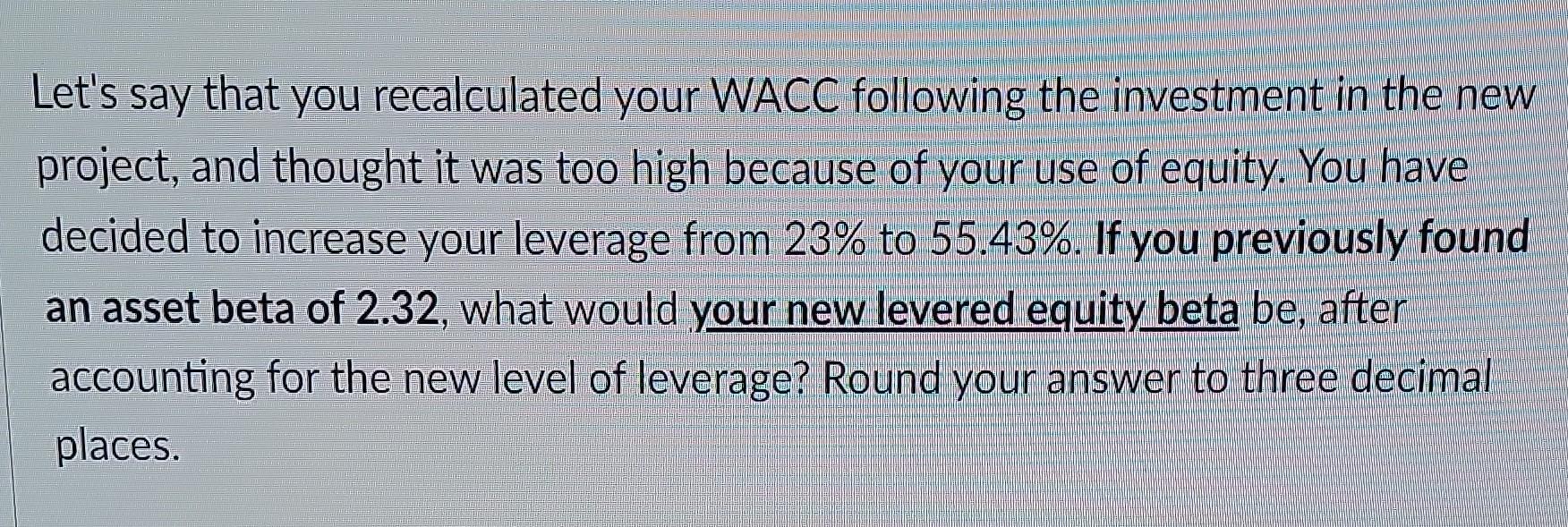

Let's say that you found a new asset beta of 1.506. What would the firm's new levered equity beta be? Round your answer to three decimal places. You will use the following information for the rest of the assignment (for anything that is not updated in later questions). You are trying to determine what would happen to your firm's WACC if you take on a new project. Your capital structure consists of 23% debt with a cost of 7% and a beta of 0.3. The market return is 12.5% and the risk-free rate is 2.5%. Your firm has invested in three projects, with 40% in project 1 (beta of 1.1 ), 15% in project 2 (beta of 1.45 ), and 45% in project 3 (beta of 2.24 ). The tax rate is 20%. First, what is your current WACC? Input your answer in decimal (not percentage) scale, rounded to three decimal places (12.11% should be entered as 0.121). Let's say that your old projects actually had a (total) asset beta of 1.85 (meaning you should ignore any and all related project/asset beta information or calculations from question 1). You are considering investing in a new project that has a beta of 1.53 and will make up 62% of the firm's total investments after the project is selected (that means it will reduce the prior projects proportionally to make up the remaining percentage of the total firm, just like if you added a new stock to a portfolio). What would the firm's new asset beta be? Round your answer to three decimal places. Let's say that you recalculated your WACC following the investment in the new project, and thought it was too high because of your use of equity. You have decided to increase your leverage from 23% to 55.43%. If you previously found an asset beta of 2.32, what would your new levered equity beta be, after accounting for the new level of leverage? Round your answer to three decimal places. Let's say that you still were not happy with your leverage, and instead decided to instead increase your leverage to 48.42% debt, and already recalculated your levered equity beta as 2.45. Given these changes, what will the firm's WACC be? Input your answer in decimal (not percentage) scale, rounded to three decimal places ( 12.11% should be entered as 0.121 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts