Question: will upvote for work shown on excel each bottle cost $10 Sammie's Lemonade plans to renew its business next summer. In an attempt to improve

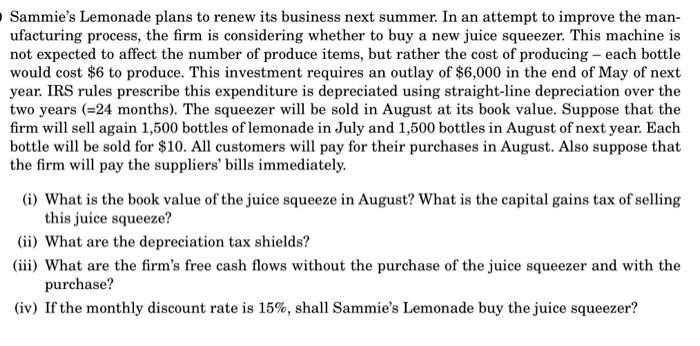

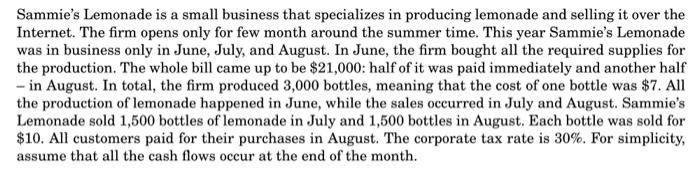

Sammie's Lemonade plans to renew its business next summer. In an attempt to improve the manufacturing process, the firm is considering whether to buy a new juice squeezer. This machine is not expected to affect the number of produce items, but rather the cost of producing - each bottle would cost $6 to produce. This investment requires an outlay of $6,000 in the end of May of next year. IRS rules prescribe this expenditure is depreciated using straight-line depreciation over the two years (=24 months). The squeezer will be sold in August at its book value. Suppose that the firm will sell again 1,500 bottles of lemonade in July and 1,500 bottles in August of next year. Each bottle will be sold for $10. All customers will pay for their purchases in August. Also suppose that the firm will pay the suppliers' bills immediately. (i) What is the book value of the juice squeeze in August? What is the capital gains tax of selling this juice squeeze? (ii) What are the depreciation tax shields? (iii) What are the firm's free cash flows without the purchase of the juice squeezer and with the purchase? (iv) If the monthly discount rate is 15%, shall Sammie's Lemonade buy the juice squeezer? Sammie's Lemonade is a small business that specializes in producing lemonade and selling it over the Internet. The firm opens only for few month around the summer time. This year Sammie's Lemonade was in business only in June, July, and August. In June, the firm bought all the required supplies for the production. The whole bill came up to be $21,000 : half of it was paid immediately and another half - in August. In total, the firm produced 3,000 bottles, meaning that the cost of one bottle was $7. All the production of lemonade happened in June, while the sales occurred in July and August. Sammie's Lemonade sold 1,500 bottles of lemonade in July and 1,500 bottles in August. Each bottle was sold for $10. All customers paid for their purchases in August. The corporate tax rate is 30%. For simplicity, assume that all the cash flows occur at the end of the month. Sammie's Lemonade plans to renew its business next summer. In an attempt to improve the manufacturing process, the firm is considering whether to buy a new juice squeezer. This machine is not expected to affect the number of produce items, but rather the cost of producing - each bottle would cost $6 to produce. This investment requires an outlay of $6,000 in the end of May of next year. IRS rules prescribe this expenditure is depreciated using straight-line depreciation over the two years (=24 months). The squeezer will be sold in August at its book value. Suppose that the firm will sell again 1,500 bottles of lemonade in July and 1,500 bottles in August of next year. Each bottle will be sold for $10. All customers will pay for their purchases in August. Also suppose that the firm will pay the suppliers' bills immediately. (i) What is the book value of the juice squeeze in August? What is the capital gains tax of selling this juice squeeze? (ii) What are the depreciation tax shields? (iii) What are the firm's free cash flows without the purchase of the juice squeezer and with the purchase? (iv) If the monthly discount rate is 15%, shall Sammie's Lemonade buy the juice squeezer? Sammie's Lemonade is a small business that specializes in producing lemonade and selling it over the Internet. The firm opens only for few month around the summer time. This year Sammie's Lemonade was in business only in June, July, and August. In June, the firm bought all the required supplies for the production. The whole bill came up to be $21,000 : half of it was paid immediately and another half - in August. In total, the firm produced 3,000 bottles, meaning that the cost of one bottle was $7. All the production of lemonade happened in June, while the sales occurred in July and August. Sammie's Lemonade sold 1,500 bottles of lemonade in July and 1,500 bottles in August. Each bottle was sold for $10. All customers paid for their purchases in August. The corporate tax rate is 30%. For simplicity, assume that all the cash flows occur at the end of the month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts