Question: will upvote if correct Homework: Chapter 11 Homework Save Score: 0 of 1 pt 7 of 9 (1 complete) HW Score: 11.11%, 1 of 9

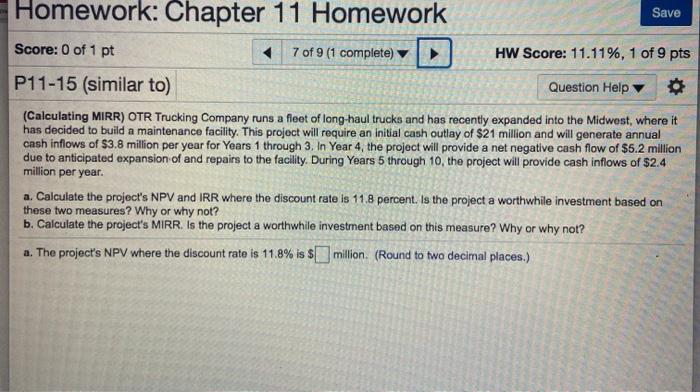

Homework: Chapter 11 Homework Save Score: 0 of 1 pt 7 of 9 (1 complete) HW Score: 11.11%, 1 of 9 pts P11-15 (similar to) Question Help (Calculating MIRR) OTR Trucking Company runs a fleet of long-haul trucks and has recently expanded into the Midwest, where it has decided to build a maintenance facility. This project will require an initial cash outlay of $21 million and will generate annual cash inflows of $3.8 million per year for Years 1 through 3. In Year 4, the project will provide a net negative cash flow of $5.2 million due to anticipated expansion of and repairs to the facility. During Years 5 through 10, the project will provide cash inflows of $2.4 million per year. a. Calculate the project's NPV and IRR where the discount rate is 11.8 percent. Is the project a worthwhile investment based on these two measures? Why or why not? b. Calculate the project's MIRR. Is the project a worthwhile investment based on this measure? Why or why not? a. The project's NPV where the discount rate is 11.8% is 6 million (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts