Question: will upvote if each one is filled in properly. PLEASE USE EXCEL WORDING (i.e., =B25-B24) Esfandairi Enterprises is considering a new three-year expansion project that

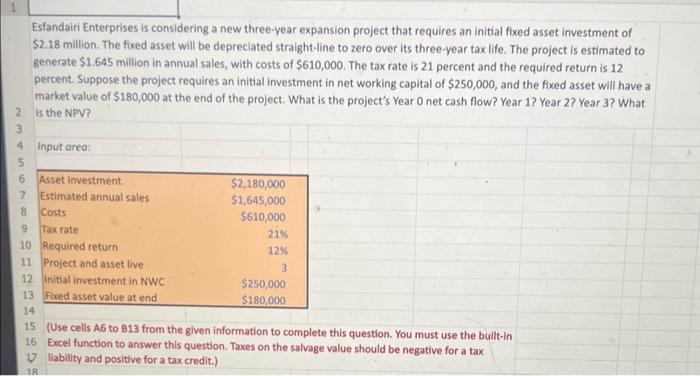

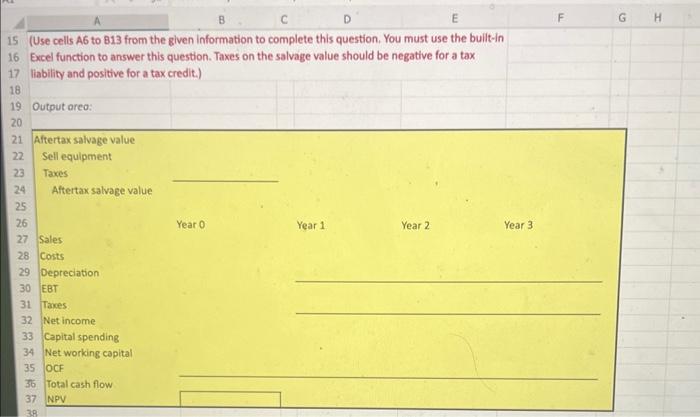

Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.18 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life. The project is estimated to generate $1.645 million in annual sales, with costs of $610,000. The tax rate is 21 percent and the required return is 12 percent. Suppose the project requires an initial investment in net working capital of $250,000, and the fixed asset will have a market value of $180,000 at the end of the project. What is the project's Year 0 net cash flow? Year 1 ? Year 2? Year 3? What is the NPV? (Use cells A6 to B13 from the given information to complete this question. You must use the bullt-in Excel function to answer this question. Taxes on the salvage value should be negative for a tax liability and positive for a tax credit.) (Use cells A6 to B13 from the given information to complete this question. You must use the bulit-in Excel function to answer this question. Taxes on the salvage value should be negative for a tax liability and positive for a tax credit.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts