Question: will upvote immediately, help with 2 quick questions ASAP 5 pts You won a local lottery! Congratulations. You have been awarded a 41-payment, constant growth

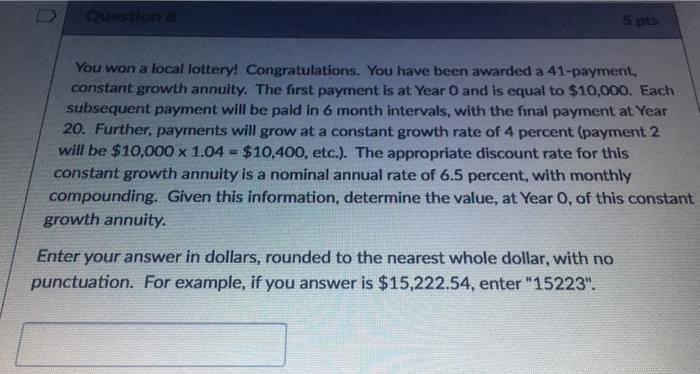

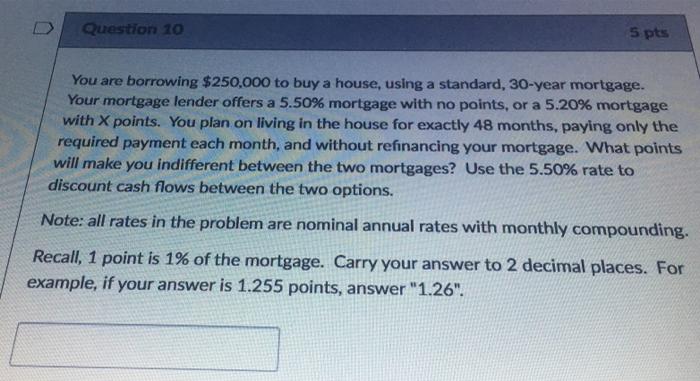

5 pts You won a local lottery! Congratulations. You have been awarded a 41-payment, constant growth annuity. The first payment is at Year 0 and is equal to $10,000. Each subsequent payment will be paid in 6 month intervals, with the final payment at Year 20. Further, payments will grow at a constant growth rate of 4 percent (payment 2 will be $10,000 x 1.04 = $10,400, etc.). The appropriate discount rate for this constant growth annuity is a nominal annual rate of 6.5 percent, with monthly compounding. Given this information, determine the value, at Year O, of this constant growth annuity. Enter your answer in dollars, rounded to the nearest whole dollar, with no punctuation. For example, if you answer is $15,222.54, enter "15223". Question 10 5 pts You are borrowing $250,000 to buy a house, using a standard, 30-year mortgage. Your mortgage lender offers a 5.50% mortgage with no points, or a 5.20% mortgage with X points. You plan on living in the house for exactly 48 months, paying only the required payment each month, and without refinancing your mortgage. What points will make you indifferent between the two mortgages? Use the 5.50% rate to discount cash flows between the two options. Note: all rates in the problem are nominal annual rates with monthly compounding. Recall, 1 point is 1% of the mortgage. Carry your answer to 2 decimal places. For example, if your answer is 1.255 points, answer "1.26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts