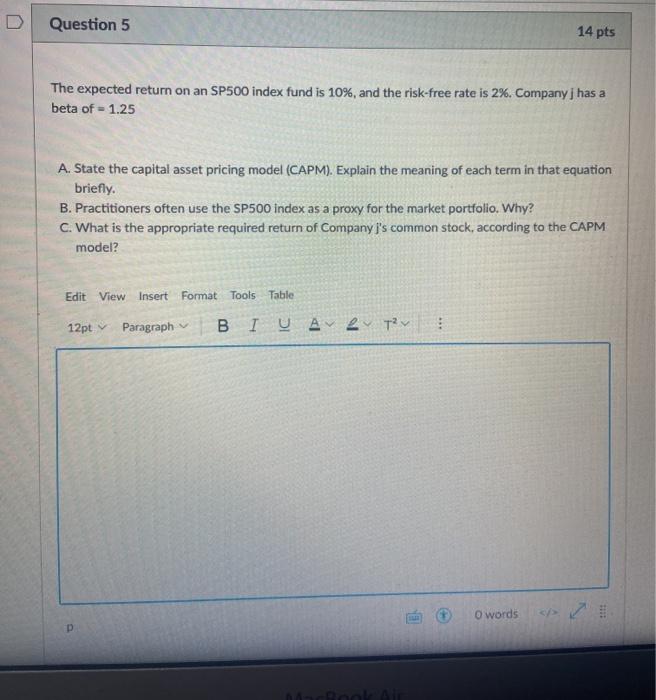

Question: will upvote solve correctly Question 5 14 pts The expected return on an SP500 index fund is 10%, and the risk-free rate is 2%. Company

Question 5 14 pts The expected return on an SP500 index fund is 10%, and the risk-free rate is 2%. Company has a beta of = 1.25 A. State the capital asset pricing model (CAPM). Explain the meaning of each term in that equation briefly. B. Practitioners often use the SP500 index as a proxy for the market portfolio. Why? C. What is the appropriate required return of Company j's common stock, according to the CAPM model? Edit View Insert Format Tools Table 12pt Paragraph BIU A Tav E O words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts