Question: Will Upvote. Use the Actual Method Record Manufacturing Costs Practice Problem 3 Purple Spirit, Inc. is an old mom-and-pop store ran by Mr. and Mrs.

Will Upvote. Use the Actual Method

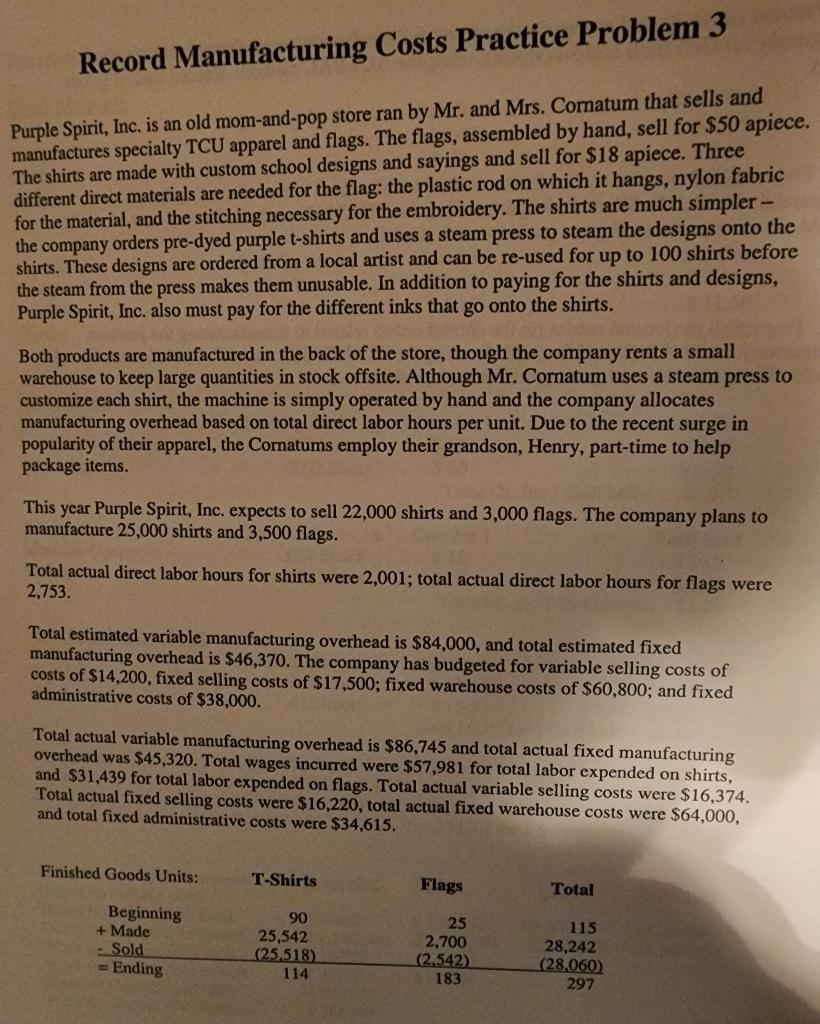

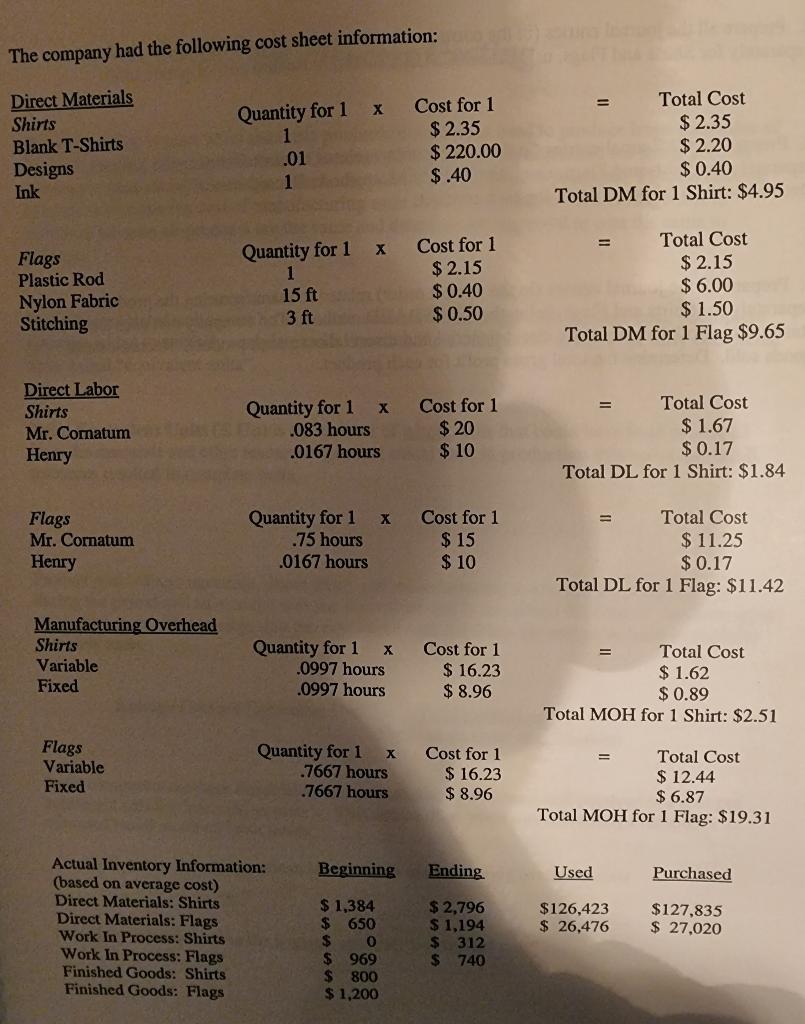

Record Manufacturing Costs Practice Problem 3 Purple Spirit, Inc. is an old mom-and-pop store ran by Mr. and Mrs. Cornatum that sells and manufactures specialty TCU apparel and flags. The flags, assembled by hand, sell for $50 apiece. The shirts are made with custom school designs and sayings and sell for $18 apiece. Three different direct materials are needed for the flag: the plastic rod on which it hangs, nylon fabric for the material, and the stitching necessary for the embroidery. The shirts are much simpler - the company orders pre-dyed purple t-shirts and uses a steam press to steam the designs onto the shirts. These designs are ordered from a local artist and can be re-used for up to 100 shirts before the steam from the press makes them unusable. In addition to paying for the shirts and designs, Purple Spirit, Inc. also must pay for the different inks that go onto the shirts. Both products are manufactured in the back of the store, though the company rents a small warehouse to keep large quantities in stock offsite. Although Mr. Cornatum uses a steam press to customize each shirt, the machine is simply operated by hand and the company allocates manufacturing overhead based on total direct labor hours per unit. Due to the recent surge in popularity of their apparel, the Cornatums employ their grandson, Henry, part-time to help package items. This year Purple Spirit, Inc. expects to sell 22,000 shirts and 3,000 flags. The company plans to manufacture 25,000 shirts and 3,500 flags. Total actual direct labor hours for shirts were 2,001; total actual direct labor hours for flags were 2,753 Total estimated variable manufacturing overhead is $84,000, and total estimated fixed manufacturing overhead is $46,370. The company has budgeted for variable selling costs of costs of $14,200, fixed selling costs of $17,500; fixed warehouse costs of $60,800; and fixed administrative costs of $38,000. Total actual variable manufacturing overhead is $86,745 and total actual fixed manufacturing overhead was $45,320. Total wages incurred were $57,981 for total labor expended on shirts, and $31,439 for total labor expended on flags. Total actual variable selling costs were $16,374. Total actual fixed selling costs were $16,220, total actual fixed warehouse costs were $64,000, and total fixed administrative costs were $34,615. Finished Goods Units: T-Shirts Flags Total Beginning + Made - Sold = Ending 90 25,542 (25.518) 114 25 2,700 (2.542) 183 115 28,242 (28,060) 297 The company had the following cost sheet information: = Direct Materials Shirts Blank T-Shirts Designs Ink Quantity for 1 1 .01 1 Cost for 1 $ 2.35 $ 220.00 $.40 Total Cost $ 2.35 $ 2.20 $ 0.40 Total DM for 1 Shirt: $4.95 Flags Plastic Rod Nylon Fabric Stitching Quantity for 1 1 15 ft 3 ft Cost for 1 $ 2.15 $ 0.40 $ 0.50 Total Cost $ 2.15 $ 6.00 $ 1.50 Total DM for 1 Flag $9.65 Direct Labor Shirts Mr. Comatum Henry Quantity for 1 .083 hours .0167 hours Cost for 1 $20 $ 10 Total Cost $ 1.67 $ 0.17 Total DL for 1 Shirt: $1.84 Flags Mr. Cornatum Henry Quantity for 1 x .75 hours .0167 hours Cost for 1 $ 15 $ 10 Total Cost $ 11.25 $ 0.17 Total DL for 1 Flag: $11.42 Manufacturing Overhead Shirts Variable Quantity for 1 .0997 hours .0997 hours Cost for 1 $ 16.23 $ 8.96 Fixed Total Cost $ 1.62 $ 0.89 Total MOH for 1 Shirt: $2.51 Flags Variable Fixed Quantity for 1 .7667 hours .7667 hours Cost for 1 $ 16.23 $ 8.96 Total Cost $ 12.44 $ 6.87 Total MOH for 1 Flag: $19.31 Beginning Ending Used Purchased Actual Inventory Information: (based on average cost) Direct Materials: Shirts Direct Materials: Flags Work In Process: Shirts Work In Process: Flags Finished Goods: Shirts Finished Goods: Flags $ 2,796 $ 1,194 $ 312 $ 740 $126,423 $ 26,476 $ 1,384 $ 650 $ O $ 969 $ 800 $ 1,200 $127,835 $ 27,020 1. Prepare all the journal entries in the correct order) related to manufacturing the product, separately for Shirts and Flags, using the ACTUAL method: Record cost of goods sold. 3. Prepare all the journal entries in the correct order) related to manufacturing the product, separately for Shirts and Flags, using the method. The company that uses the standard method does not track direct material and direct labor to each product. Record cost of goods sold. Determine the total gross profit for each product. use actual method Record Manufacturing Costs Practice Problem 3 Purple Spirit, Inc. is an old mom-and-pop store ran by Mr. and Mrs. Cornatum that sells and manufactures specialty TCU apparel and flags. The flags, assembled by hand, sell for $50 apiece. The shirts are made with custom school designs and sayings and sell for $18 apiece. Three different direct materials are needed for the flag: the plastic rod on which it hangs, nylon fabric for the material, and the stitching necessary for the embroidery. The shirts are much simpler - the company orders pre-dyed purple t-shirts and uses a steam press to steam the designs onto the shirts. These designs are ordered from a local artist and can be re-used for up to 100 shirts before the steam from the press makes them unusable. In addition to paying for the shirts and designs, Purple Spirit, Inc. also must pay for the different inks that go onto the shirts. Both products are manufactured in the back of the store, though the company rents a small warehouse to keep large quantities in stock offsite. Although Mr. Cornatum uses a steam press to customize each shirt, the machine is simply operated by hand and the company allocates manufacturing overhead based on total direct labor hours per unit. Due to the recent surge in popularity of their apparel, the Cornatums employ their grandson, Henry, part-time to help package items. This year Purple Spirit, Inc. expects to sell 22,000 shirts and 3,000 flags. The company plans to manufacture 25,000 shirts and 3,500 flags. Total actual direct labor hours for shirts were 2,001; total actual direct labor hours for flags were 2,753 Total estimated variable manufacturing overhead is $84,000, and total estimated fixed manufacturing overhead is $46,370. The company has budgeted for variable selling costs of costs of $14,200, fixed selling costs of $17,500; fixed warehouse costs of $60,800; and fixed administrative costs of $38,000. Total actual variable manufacturing overhead is $86,745 and total actual fixed manufacturing overhead was $45,320. Total wages incurred were $57,981 for total labor expended on shirts, and $31,439 for total labor expended on flags. Total actual variable selling costs were $16,374. Total actual fixed selling costs were $16,220, total actual fixed warehouse costs were $64,000, and total fixed administrative costs were $34,615. Finished Goods Units: T-Shirts Flags Total Beginning + Made - Sold = Ending 90 25,542 (25.518) 114 25 2,700 (2.542) 183 115 28,242 (28,060) 297 The company had the following cost sheet information: = Direct Materials Shirts Blank T-Shirts Designs Ink Quantity for 1 1 .01 1 Cost for 1 $ 2.35 $ 220.00 $.40 Total Cost $ 2.35 $ 2.20 $ 0.40 Total DM for 1 Shirt: $4.95 Flags Plastic Rod Nylon Fabric Stitching Quantity for 1 1 15 ft 3 ft Cost for 1 $ 2.15 $ 0.40 $ 0.50 Total Cost $ 2.15 $ 6.00 $ 1.50 Total DM for 1 Flag $9.65 Direct Labor Shirts Mr. Comatum Henry Quantity for 1 .083 hours .0167 hours Cost for 1 $20 $ 10 Total Cost $ 1.67 $ 0.17 Total DL for 1 Shirt: $1.84 Flags Mr. Cornatum Henry Quantity for 1 x .75 hours .0167 hours Cost for 1 $ 15 $ 10 Total Cost $ 11.25 $ 0.17 Total DL for 1 Flag: $11.42 Manufacturing Overhead Shirts Variable Quantity for 1 .0997 hours .0997 hours Cost for 1 $ 16.23 $ 8.96 Fixed Total Cost $ 1.62 $ 0.89 Total MOH for 1 Shirt: $2.51 Flags Variable Fixed Quantity for 1 .7667 hours .7667 hours Cost for 1 $ 16.23 $ 8.96 Total Cost $ 12.44 $ 6.87 Total MOH for 1 Flag: $19.31 Beginning Ending Used Purchased Actual Inventory Information: (based on average cost) Direct Materials: Shirts Direct Materials: Flags Work In Process: Shirts Work In Process: Flags Finished Goods: Shirts Finished Goods: Flags $ 2,796 $ 1,194 $ 312 $ 740 $126,423 $ 26,476 $ 1,384 $ 650 $ O $ 969 $ 800 $ 1,200 $127,835 $ 27,020 1. Prepare all the journal entries in the correct order) related to manufacturing the product, separately for Shirts and Flags, using the ACTUAL method: Record cost of goods sold. 3. Prepare all the journal entries in the correct order) related to manufacturing the product, separately for Shirts and Flags, using the method. The company that uses the standard method does not track direct material and direct labor to each product. Record cost of goods sold. Determine the total gross profit for each product. use actual method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts