Question: ** Will you guys please show me mathmatically how to solve this equation (rather than show me how you have gotten the answer using excel).

** Will you guys please show me mathmatically how to solve this equation (rather than show me how you have gotten the answer using excel). This will help me better understand the material when solving for future problems. Thank you!!

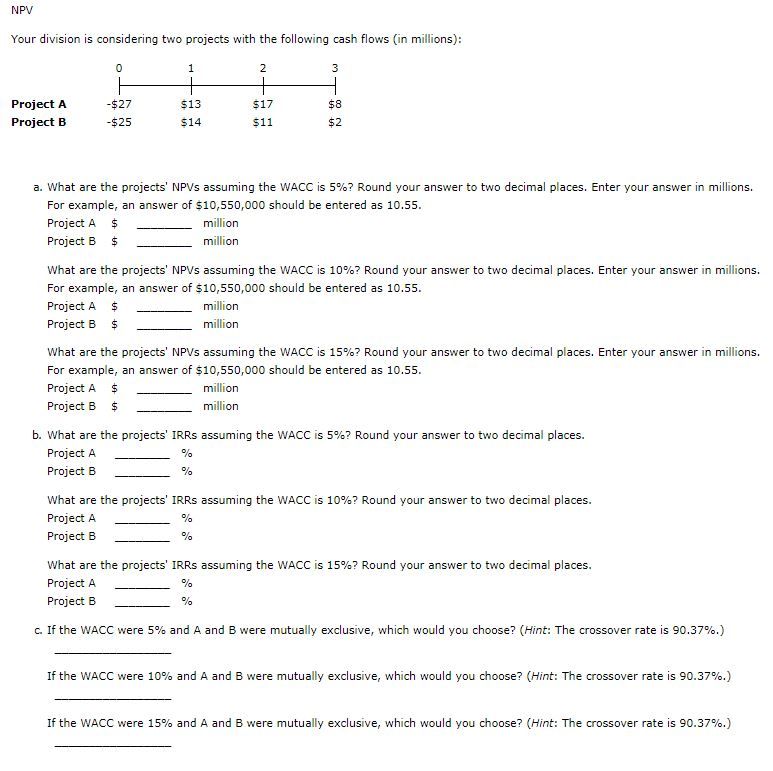

NPV Your division is considering two projects with the following cash flows in millions): $27 $25 $8 $2 $13 Project A Project B $17 $11 $14 a. what are the projects' NPVs assuming the WACC is 5%? Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55 Project A Project B mill million what are the projects' NPVs assuming the WACC is 10%? Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55 Project A Project B $ million million What are the projects' NPVs assuming the WACC is 15%? Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55 Project A Project B $ million million b. what are the projects' IRRs assuming the WACC is 5%? Round your answer to two decimal places. Project A Project B What are the projects' IRRs assuming the WACC is 10%? Round your answer to two decimal places. Project A Project B What are the projects' IRRs assuming the WACC is 15%? Round your answer to two decimal places Project A Project B c. If the WACC were 5% and A and B were mutually exclusive, which would you choose? (Hint: The crossover rate is 90.37%.) If the WACC were 10% and A and B were mutually exclusive, which would you choose? (Hint: The crossover rate is 90.37%.) If the WACC were 15% and A and B were mutually exclusive, which would you choose? (Hint: The crossover rate is 90.37%.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts