Question: Will you please show the work so I can know! Thank you! Problem 6-14 (a): Expectations Theory and Inflation Suppose 2-year Treasury bonds yield 5.5%,

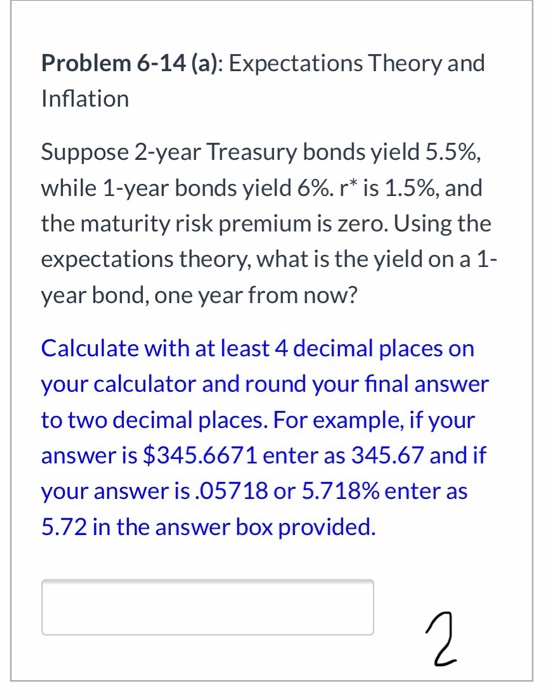

Problem 6-14 (a): Expectations Theory and Inflation Suppose 2-year Treasury bonds yield 5.5%, while 1-year bonds yield 6%. r* is 1.5%, and the maturity risk premium is zero. Using the expectations theory, what is the yield on a 1 year bond, one year from now? Calculate with at least 4 decimal places on your calculator and round your final answer to two decimal places. For example, if your answer is $345.6671 enter as 345.67 and if your answer is.05718 or 5.718% enter as 5.72 in the answer box provided. 22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts