Question: will you still solve it? that is the question As of January 1, 20X3, Lavender's Dress Shop installed the retail method of accounting for its

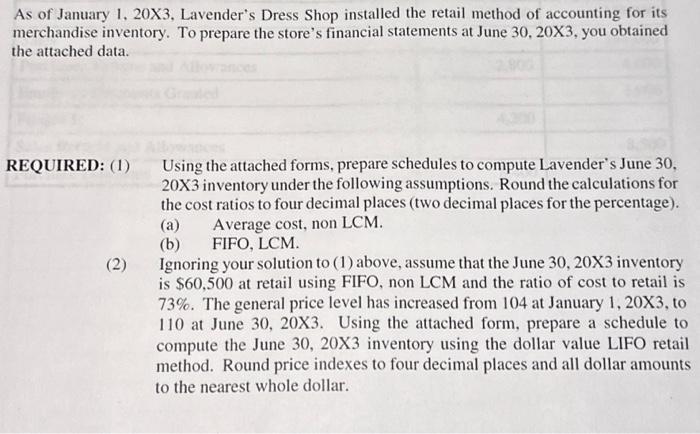

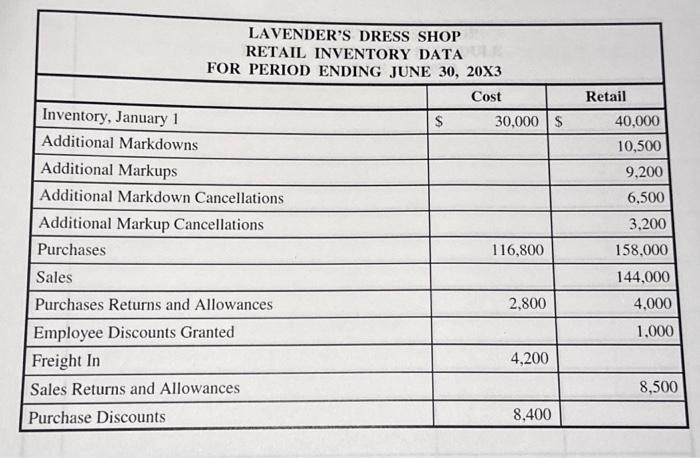

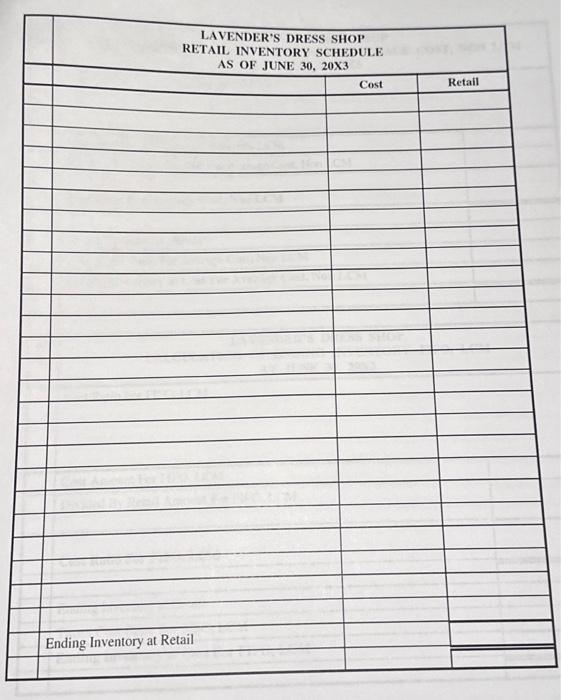

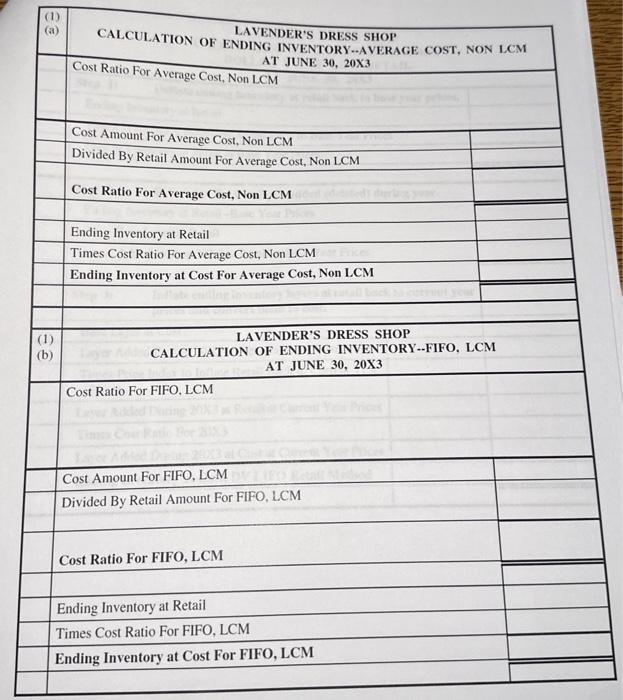

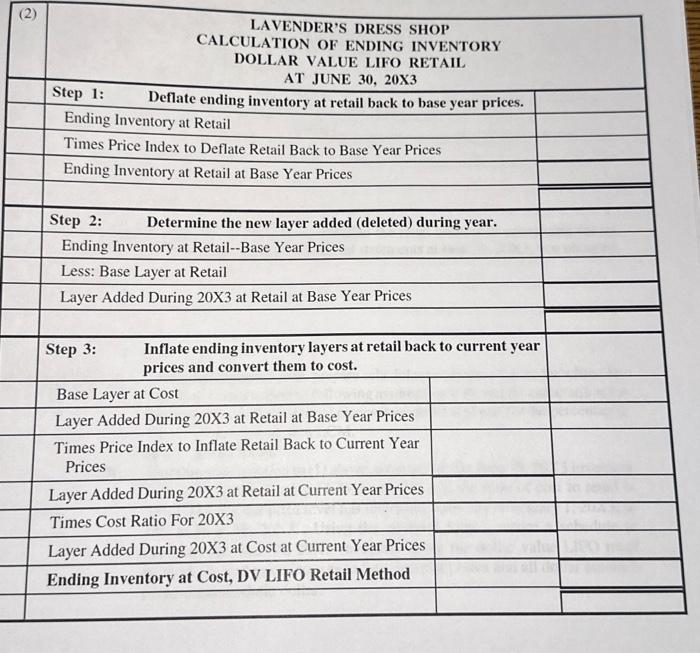

As of January 1, 20X3, Lavender's Dress Shop installed the retail method of accounting for its merchandise inventory. To prepare the store's financial statements at June 30,203, you obtained the attached data. REQUIRED: ( 1 ) Using the attached forms, prepare schedules to compute Lavender's June 30 , 20X3 inventory under the following assumptions. Round the calculations for the cost ratios to four decimal places (two decimal places for the percentage). (a) Average cost, non LCM. (b) FIFO, LCM. Ignoring your solution to (1) above, assume that the June 30,20X3 inventory is $60,500 at retail using FIFO, non LCM and the ratio of cost to retail is 73%. The general price level has increased from 104 at January 1,203, to 110 at June 30,203. Using the attached form, prepare a schedule to compute the June 30,203 inventory using the dollar value LIFO retail method. Round price indexes to four decimal places and all dollar amounts to the nearest whole dollar. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{\begin{tabular}{c} LAVENDER'S DRESS SHOP \\ RETAIL INVENTORY DATA \\ FOR PERIOD ENDING JUNE 30,203 \\ \end{tabular}} \\ \hline & \multicolumn{2}{|c|}{ Cost } & Retail \\ \hline Inventory, January 1 & $ & 30,000 & 40,000 \\ \hline Additional Markdowns & & & 10,500 \\ \hline Additional Markups & & & 9,200 \\ \hline Additional Markdown Cancellations & & & 6,500 \\ \hline Additional Markup Cancellations & & & 3,200 \\ \hline Purchases & & 116,800 & 158,000 \\ \hline Sales & & & 144,000 \\ \hline Purchases Returns and Allowances & & 2,800 & 4,000 \\ \hline Employee Discounts Granted & & & 1,000 \\ \hline Freight In & & 4,200 & \\ \hline Sales Returns and Allowances & & & 8,500 \\ \hline Purchase Discounts & & 8,400 & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline & \multicolumn{4}{|c|}{\begin{tabular}{l} LAVENDER'S DRESS SHOP \\ RETAIL INVENTORY SCHEDULE \\ AS OF JUNE 30, 20X3 \end{tabular}} \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline (2) & \multicolumn{3}{|c|}{\begin{tabular}{c} LAVENDER'S DRESS SHOP \\ CALCULATION OF ENDING INVENTORY \\ DOLLAR VALUE LIFO RETAIL \\ AT JUNE 30,203 \\ \end{tabular}} \\ \hline & \multicolumn{2}{|c|}{ Deflate ending inventory at retail back to base year prices. } & \\ \hline & \multicolumn{2}{|c|}{ Ending Inventory at Retail } & \\ \hline & \multicolumn{2}{|l|}{ Times Price Index to Deflate Retail Back to Base Year Prices } & \\ \hline & \multicolumn{2}{|l|}{ Ending Inventory at Retail at Base Year Prices } & \\ \hline & \multicolumn{2}{|c|}{ Determine the new layer added (deleted) during year. } & \\ \hline & \multicolumn{2}{|l|}{ Ending Inventory at Retail--Base Year Prices } & \\ \hline & \multicolumn{2}{|l|}{ Less: Base Layer at Retail } & \\ \hline & \multicolumn{2}{|l|}{ Layer Added During 203 at Retail at Base Year Prices } & \\ \hline & \multicolumn{2}{|c|}{\begin{tabular}{l} Inflate ending inventory layers at retail back to current year \\ prices and convert them to cost. \end{tabular}} & \\ \hline & \multicolumn{2}{|l|}{ Base Layer at Cost } & \\ \hline & \multicolumn{2}{|l|}{ Layer Added During 20X3 at Retail at Base Year Prices } & \\ \hline & \multicolumn{2}{|l|}{\begin{tabular}{l} Times Price Index to Inflate Retail Back to Current Year \\ Prices \end{tabular}} & \\ \hline & \multicolumn{2}{|l|}{ Layer Added During 20X3 at Retail at Current Year Prices } & \\ \hline & \multicolumn{2}{|l|}{ Times Cost Ratio For 20X3} & \\ \hline & \multicolumn{2}{|l|}{ Layer Added During 20X3 at Cost at Current Year Prices } & \\ \hline & \multicolumn{2}{|l|}{ Ending Inventory at Cost, DV LIFO Retail Method } & \\ \hline & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts