Question: William Oliver Bootmaker Executive Summary William Oliver, Bootmaker is a known brand in the United Kingdom having been in existence since the 1800s. Its legacy

William Oliver Bootmaker

Executive Summary

William Oliver, Bootmaker is a known brand in the United Kingdom having been in existence since the 1800s. Its legacy and reputation for quality and craftsmanship stems from supplying and custom-making shoes for the monarchy from the 1800s to the 1900s.

The company is currently at a crossroads. A major decision has to be made for its pricing strategy. Although the company continues to show revenues in the millions, its has only been breaking even the last few years. Its latest results in 2005 has shown losses of $400M.

A potential key to its turnaround is the pricing strategy. Although the business has historically implemented full-cost plus pricing, there may be other available pricing strategies that the company may consider to turn the business around.

The management needs to make a decision whether the new pricing strategy can allow it to maintain its competitive position and maintain its reputation for high quality craftsmanship.

The following options to target a proper pricing strategy were presented: Value-based pricing whereby the company can determine the perceived pricing for their products and price it as such; Dynamic Pricing is also an option whereby the company can price its product up or down depending on perceived demand. This may be a tad confusing and may affect its brand image. The company may also choose to stay with cost plus pricing and eliminate third party retailers.

Add: options posited - done

Add: final choice

Add: Implementation

Introduction

William Oliver, Bootmaker is a company that has been in existence since the 1800s. Its legacy stems from the original owners building the company's reputation by custom making shoes for the monarchy from the late 1800s to the 1900s.

Its core competence and value is its craftsmanship. The company prides itself in the consistency of the stitching and quality of its work along with the exclusivity of its product. Although modern shoemaking capabilities has been implemented in the company, William Oliver, Bootmaker still to this day values traditional craftmanship evident in all its products.

Fast forward to today, the company is currently at a crossroads. Competition, along with increasing income has caused the company to question its pricing strategy.

A consultant has questioned the effectivity of the company's full-cost plus pricing strategy alongside its branding and competitive positioning strategy. There currently appears to be a mismatch between the pricing strategy and the company's positioning. The consultant further explained that luxury brands have income elasticity of 1 which means that the demand for luxury brands increase by more than 1 percent when income rises. Hence there is an opportunity to seriously review the pricing strategy.

The company posits that full-cost plus pricing is the most effective strategy given William Oliver, Bootmaker is already at the top end of the luxury shoe market. Its average price is $450, with the crocodile skin line retailing between $850 to $1000. The company only produces custom order rather than for stock.

Current sales revenue is approximately 6.5Million pounds. Given the pointers raised by the consultant, the company has started questioning the effectivity of its pricing strategy as it showed losses of 400M in 2005 with the previous years showing breakeven. This is due partially to the opening o fa new retail outlet in London which resulted in various expenses.

At this point, the management of William Oliver, Bootmaker feel as though they are locked in with their pricing strategy. Management does believe that luxury pricing is the right strategy as the company maintains the quality and high craftsmanship that it has been known for throughout the years.

Problem Statement

The main issue that the company faces, given its huge losses, is whether to maintain its long-standing full-cost plus pricing strategy or completely overhaul this pricing.

The choice of pricing strategy will be key to the company's turnaround, as it has been breaking even for the last few years and posted losses in its last financial results.

The choice of pricing strategy has to maintain the company's competitive position in the luxury brand market, along with its reputation for quality and craftsmanship.

Comprehensive Analysis

William Oliver, as a manufacturer of luxury shoes, uses a focus differentiation strategy that requires offering unique features that accomplish the demands of its narrow, niche market. A niche market is a small, peculiar, and well-defined part of a larger market targeted where people and organizations buy and sell products and services. The uniqueness of its shoes imbedded in the craftsmanship and quality of materials used in production. To maintain the position in the niche market, it must continue to satisfy the demand for "uniqueness" in its narrow market. Focus differentiation strategy is only effective to the extent in which William Oliver can match its shoes to its niche market. As a result, profit is sensitive to changes in the business model. Some of the reasons for the huge losses faced by the company are:

- Deviation from its business model of producing based customer orders to stocking.

- High post factory gate cost.

- Uncertainty of the firm's demand curve.

- Additional costs incurred on the new retailing outlet in London without a corresponding increase in revenue to at least break-even at the location.

We will use SWOT (strength, weakness, opportunities, and threats) analysis, value chain analysis and financial analysis to evaluate William Oliver's position in the industry to better understand how these issues it's facing can be addressed.

SWOT Analysis: This is a tool the management of William Oliver can use to consider the firm's strengths and weaknesses in its internal environment along with the opportunities and threats that exist in its external environment. To either keep the current pricing system or overhaul it and start making profits, the management will use this analysis to compare internal & external factors to create business models on how the firm might become more successful.

Strengths:

- Quality of its products made from top notch materials, craftsmanship and peculiar designs.

- Brand recognition as a luxury product since the 19th century.

- Unique manufacturing process that still utilizes traditional skills.

Weakness: The management should steer away or minimize these weaknesses:

- The new outlet opened in London sounds like a premature idea related to production for stock rather than to production to customer order. Since the revenue generated from the location is lower than the cost, I believe it's best if the company looks for the best way to let go of this location and other costs related to it.

- Limited manufacturing cost reduction possibilities

- Potential loss of highly skilled workers

Opportunities: Capitalize on untapped market opportunities some of which are listed below

- The company can expand its services by selling directly to the final customers, which can reduce the post factory gate cost, thereby reducing prices.

- In today's e-commerce world, there is a lot of buying and selling over the internet. The company can also move in this direction by reducing/eliminating cost associated with retailing as the shoes will go from production/warehouse directly to the customers.

- Increase advertising to create more awareness on the uniqueness of its product and its manufacturing process. It can include the company's This medium can also be used to emphasize on the company's possible reduced energy consumption and carbon due to its traditional shoemaking method employed as opposed to lots of machinery processes which is a good thing for the environment.

Threats: These are the threats the against the that management should be aware of an protect the company from, if possible:

- Uncertainty of the demand curve.

- High prices charged by retailers to customers.

- Less expensive, adequate close substitutes.

- Prices among rivals are significantly less.

The end of the SWOT analysis is to create-an improved value chain management business model that will be used to supply shoes at a reduced cost.

Value Chain Analysis: High post factory gate costs are one of the reasons why the cost of the company's shoes is high, which also leads to the high prices charged. The management of the company should work on creating an improved value chain path to deliver the shoes to its customers. This will increase value added to the primary and support activities aspect of the supply chain thereby enhancing product and services offered to customers while reducing cost. An option from the SWOT analysis above is to eliminate middlemen (wholesalers) and their related cost included in the final price to customers and embrace e-commerce. The company's sale at retail prices will increase profit margins and will absorb the non-recovery manufacturing overhead costs.

Financial Data Analysis:

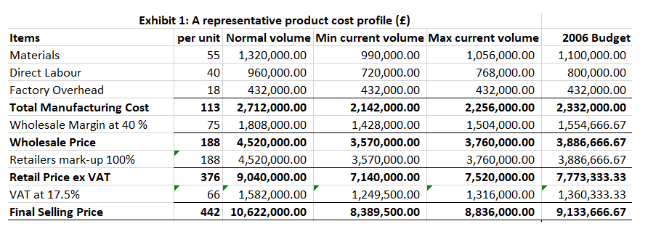

From Exhibit 1, manufacturing cost is $113, and the final selling ex VAT is 376. Other costs the company will incur will be related to increased advertising and customer awareness on the new strategy, shipping costs to customers, cost of running a good website and potentially cost of storing manufactured shoes in warehouses pending on shipment to customers. There is a high chance that these additional costs won't sum up to the retailer's mark-up of $188 in exhibit 1. Hence, it gives the company a better profit margin as the total cost will be less than $376 while the price may still remain at $442.

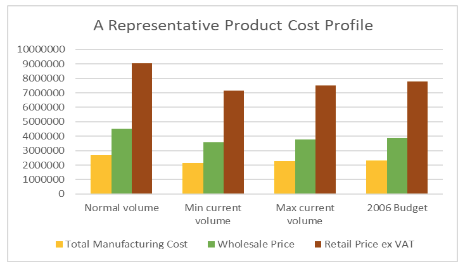

Exhibit 1: A representative product cost profile (f) Items per unit Normal volume Min current volume Max current volume 2006 Budget Materials 55 1,320,000.00 990,000.00 1,056,000.00 1,100,000.00 Direct Labour 40 960,000.00 720,000.00 768,000.00 800,000.00 Factory Overhead 18 432,000.00 432,000.00 432,000.00 432,000.00 Total Manufacturing Cost 113 2,712,000.00 2,142,000.00 2,256,000.00 2,352,000.00 Wholesale Margin at 40% 75 1,808,000.00 1,428,000.00 1,504,000.00 1,554,666.67 Wholesale Price 188 4,520,000.00 3,570,000.00 3,760,000.00 3,886,666.67 Retailers mark-up 100% 188 4,520,000.00 3,570,000.00 3,760,000.00 3,886,666.67 Retail Price ex VAT 376 9,040,000.00 7,140,000.00 7,520,000.00 7,773,333.33 VAT at 17.5% 66 1,582,000.00 1,249,500.00 1,316,000.00 1,360,333.33 Final Selling Price 442 10,622,000.00 8,389,500.00 8,836,000.00 9,133,666.67A Representative Product Cost Profile 10000000 9000000 8000000 7000000 6000000 5000000 4000000 3000000 2000000 1000000 Normal volume Min current Max current 2006 Budget volume volume Total Manufacturing Cost Wholesale Price Retail Price ex VAT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts