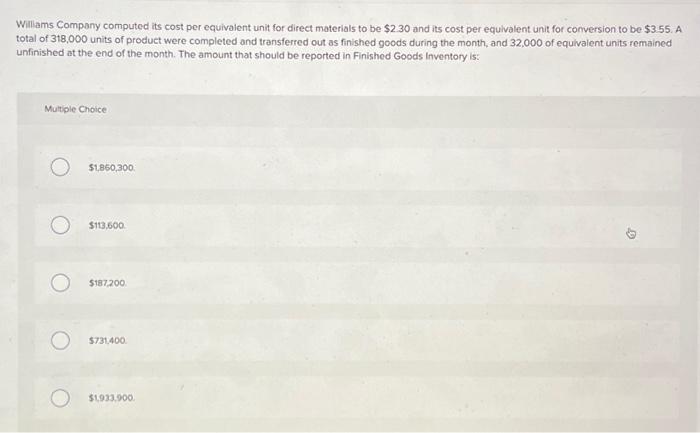

Question: Williams Company computed its cost per equivalent unit for direct materials to be $2.30 and its cost per equivalent unit for conversion to be $3.55.

Willams Company computed its cost per equivalent unit for direct materials to be $2.30 and its cost per equivalent unit for conversion to be $3.55. A total of 318,000 units of product were completed and transferred out as finished goods during the month, and 32,000 of equivalent units remained unfinished at the end of the month. The amount that should be reported in Finished Goods Inventory is: Multiple Choice 51,860,300 $113,600 $187200 5731,400 51933.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts