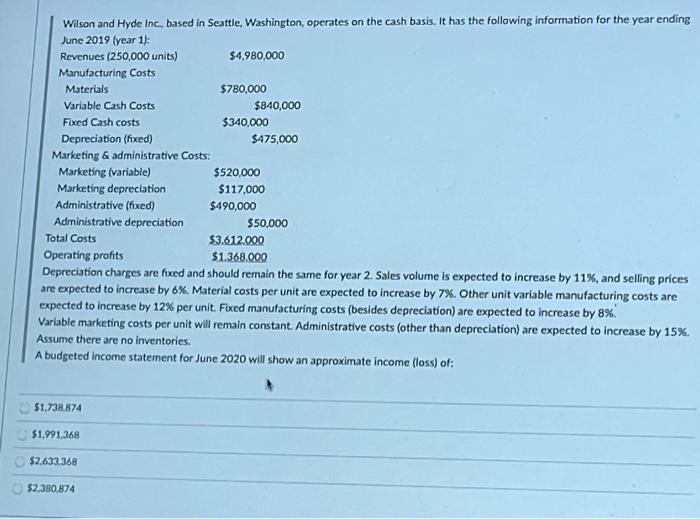

Question: Wilson and Hyde Inc, based in Seattle, Washington, operates on the cash basis. It has the following information for the year ending June 2019

Wilson and Hyde Inc, based in Seattle, Washington, operates on the cash basis. It has the following information for the year ending June 2019 (year 1): Revenues (250,000 units) $4.980,000 Manufacturing Costs Materials $780,000 Variable Cash Costs $840,000 Fixed Cash costs $340,000 Depreciation (fixed) $475,000 Marketing & administrative Costs: Marketing (variable) $520,000 Marketing depreclation Administrative (fixed) $117,000 $490,000 Administrative depreciation $50,000 Total Costs $3.612.000 Operating profits $1.368,000 Depreciation charges are fxed and should remain the same for year 2. Sales volume is expected to increase by 11%, and selling prices are expected to increase by 6%. Material costs per unit are expected to increase by 7%. Other unit varable manufacturing costs are expected to increase by 12% per unit. Fixed manufacturing costs (besides depreciation) are expected to increase by 8%. Variable marketing costs per unit will remain constant. Administrative costs (other than depreclation) are expected to increase by 15%. Assume there are no inventories. A budgeted income statement for June 2020 will show an approximate income (loss) of: $1,738.874 $1,991,368 $2.633.368 $2.380.874

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Income Statement for June 2020 Particular Amount A... View full answer

Get step-by-step solutions from verified subject matter experts