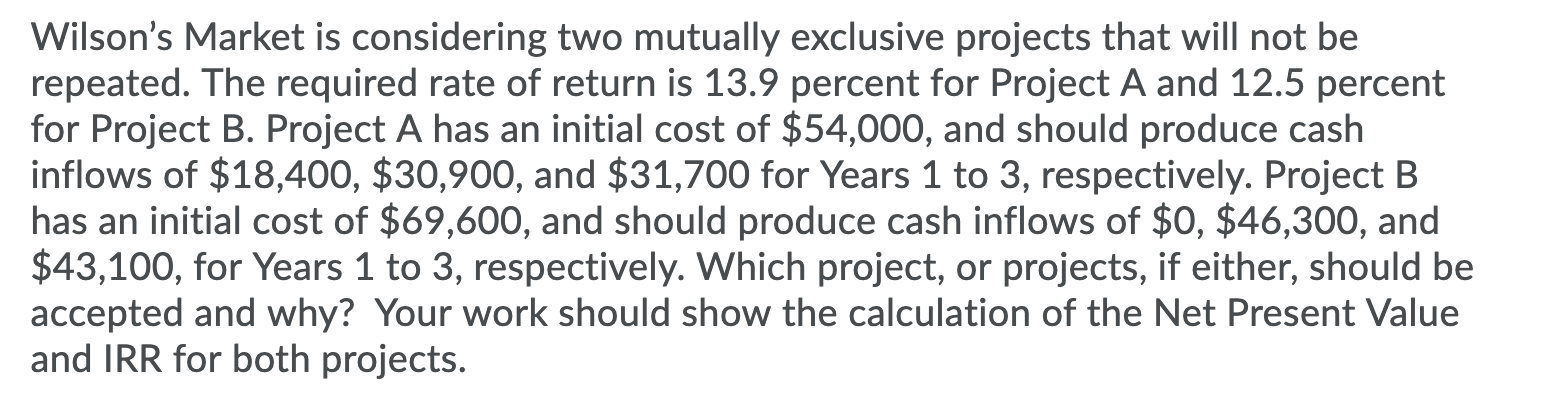

Question: Wilson's Market is considering two mutually exclusive projects that will not be repeated. The required rate of return is 13.9 percent for Project A and

Wilson's Market is considering two mutually exclusive projects that will not be repeated. The required rate of return is 13.9 percent for Project A and 12.5 percent for Project B. Project A has an initial cost of $54,000, and should produce cash inflows of $18,400, $30,900, and $31,700 for Years 1 to 3, respectively. Project B has an initial cost of $69,600, and should produce cash inflows of $0, $46,300, and $43,100, for Years 1 to 3, respectively. Which project, or projects, if either, should be accepted and why? Your work should show the calculation of the Net Present Value and IRR for both projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts