Question: win about $ 1 5 0 , 0 0 0 each year and asks your advice on depreciation of the truck. You tell him: Bonus

win about $ each year and asks your advice on depreciation of the truck. You tell him:

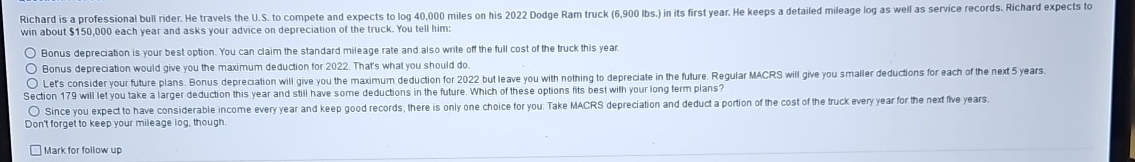

Bonus depreciation is your best option. You can claim the standard mileage rate and also write off the full cost of the truck this year.

Bonus depreciation would give you the maximum deduction for That's what you should do

Lets consider your future plans. Bonus depreciation will give you the maximum deduction for but leave you with nothing to depreciate in the future. Regular MACRS will give you smaller deductions for each of the next years. Section will let you take a larger deduction this year and still have some deductions in the future. Which of these options fits best with your long term plans?

Since you exped to have considerable income every year and keep good records, there is only one choice for you: Take MACRS depreciation and deduct a portion of the cost of the truck every year for the next five years. Don't forget to keep your mileage log though.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock