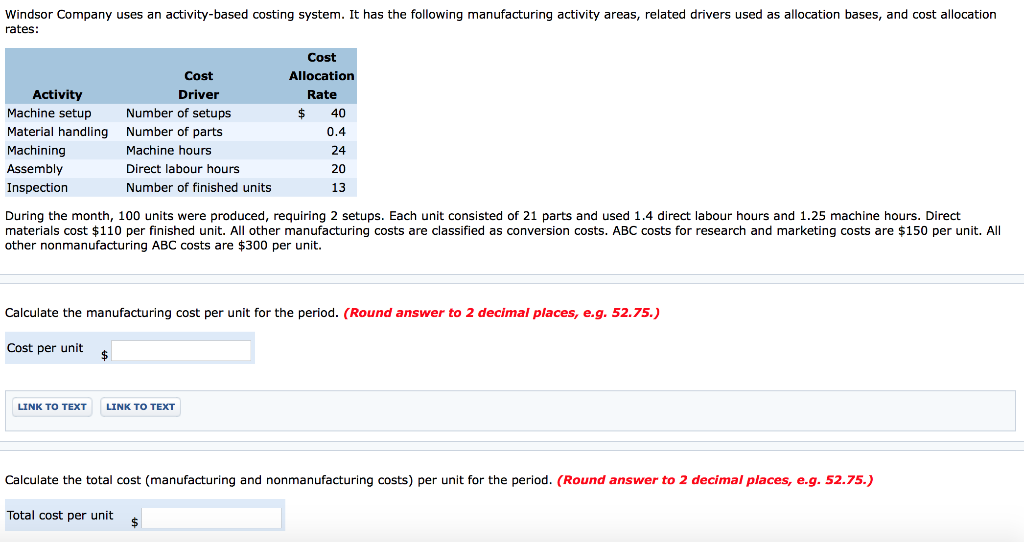

Question: Windsor Company uses an activity-based costing system. It has the following manufacturing activity areas, related drivers used as allocation bases, and cost allocation rates: Cost

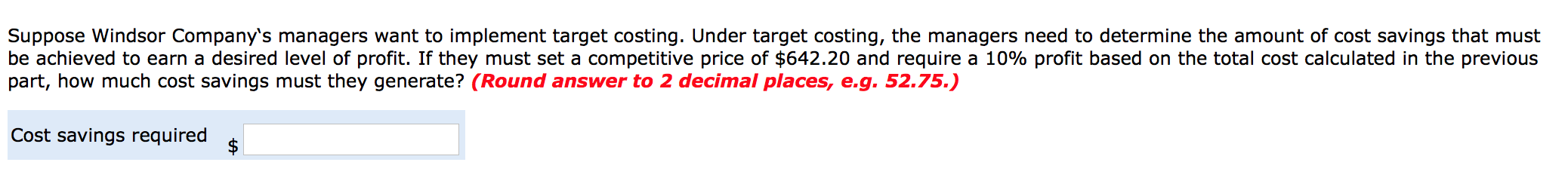

Windsor Company uses an activity-based costing system. It has the following manufacturing activity areas, related drivers used as allocation bases, and cost allocation rates: Cost Allocation Rate $ 40 0.4 Cost Driver Number of setups Number of parts Machine hours Direct labour hours Number of finished units Activity Machine setup Material handling Machining Assembly Inspection During the month, 100 units were produced, requiring 2 setups. Each unit consisted of 21 parts and used 1.4 direct labour hours and 1.25 machine hours. Direct materials cost $110 per finished unit. All other manufacturing costs are classified as conversion costs. ABC costs for research and marketing costs are $150 per unit. All other nonmanufacturing ABC costs are $300 per unit. Calculate the manufacturing cost per unit for the period. (Round answer to 2 decimal places, e.g. 52.75.) Cost per units LINK TO TEXT LINK TO TEXT Calculate the total cost (manufacturing and nonmanufacturing costs) per unit for the period. (Round answer to 2 decimal places, e.g. 52.75.) Total cost per units Suppose Windsor Company's managers want to implement target costing. Under target costing, the managers need to determine the amount of cost savings that must be achieved to earn a desired level of profit. If they must set a competitive price of $642.20 and require a 10% profit based on the total cost calculated in the previous part, how much cost savings must they generate? (Round answer to 2 decimal places, e.g. 52.75.) Cost savings required $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts