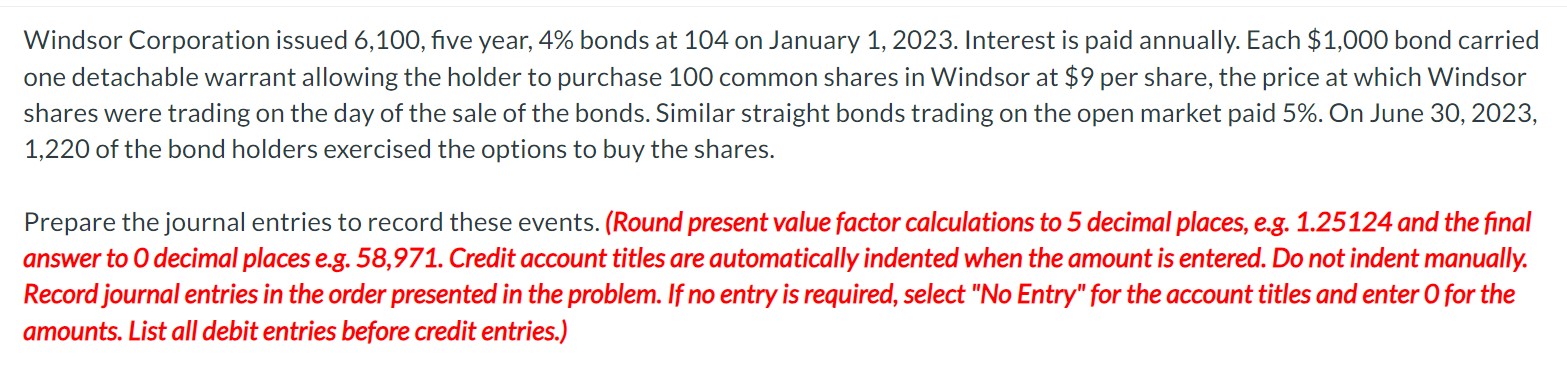

Question: Windsor Corporation issued 6 , 1 0 0 , five year, 4 % bonds at 1 0 4 on January 1 , 2 0 2

Windsor Corporation issued five year, bonds at on January Interest is paid annually. Each $ bond carried

one detachable warrant allowing the holder to purchase common shares in Windsor at $ per share, the price at which Windsor

shares were trading on the day of the sale of the bonds. Similar straight bonds trading on the open market paid On June

of the bond holders exercised the options to buy the shares.

Prepare the journal entries to record these events. Round present value factor calculations to decimal places, eg and the final

answer to decimal places eg Credit account titles are automatically indented when the amount is entered. Do not indent manually.

Record journal entries in the order presented in the problem. If no entry is required, select No Entry" for the account titles and enter for the

amounts. List all debit entries before credit entries.

Contributed Surplus Stock Warrants

Bonds Payable

June

Contributed Surplus Stock Warrants

Common Shares

Account names and date are correct. Numbers can be wrong, Plz share with me the detailed formula and solving process. I want to learn from here. Thank you

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock