Question: Windsor Enterprises is using a discounted cash flow model. Identify which model Windsor might use to estimate the discounted fair value under each scenario, and

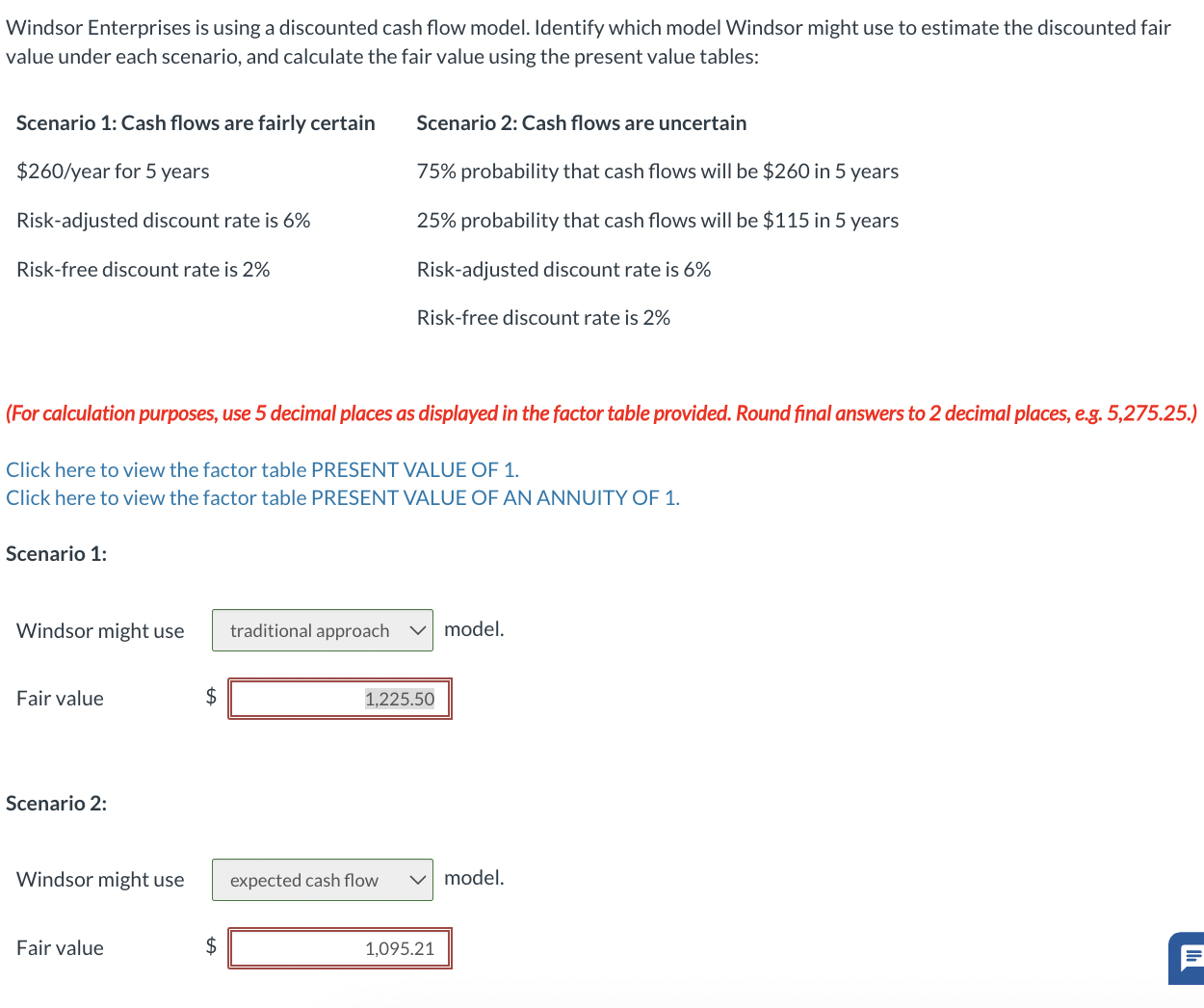

Windsor Enterprises is using a discounted cash flow model. Identify which model Windsor might use to estimate the discounted fair

value under each scenario, and calculate the fair value using the present value tables:

Scenario : Cash flows are fairly certain Scenario : Cash flows are uncertain

$ year for years probability that cash flows will be $ in years

Riskadjusted discount rate is probability that cash flows will be $ in years

Riskfree discount rate is Riskadjusted discount rate is

Riskfree discount rate is

For calculation purposes, use decimal places as displayed in the factor table provided. Round final answers to decimal places, eg

Click here to view the factor table PRESENT VALUE OF

Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF

Scenario :

Windsor might use

model.

Fair value

$

Scenario :

Windsor might use

model.

Fair value

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock