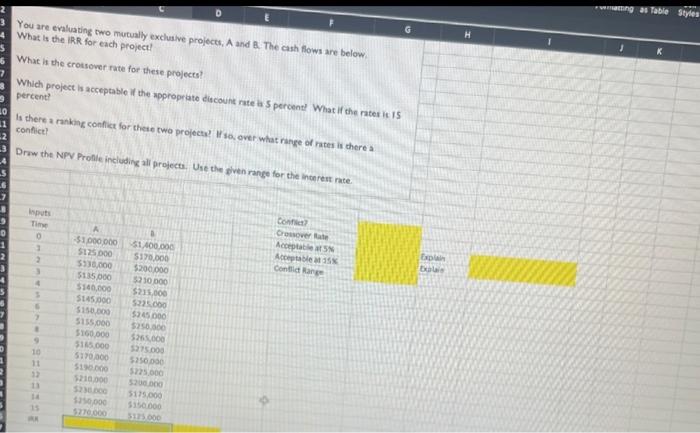

Question: wing as Table Styles D G K 3 You are evaluating two mutually exclusive projects, A and B The cash flows are below What is

wing as Table Styles D G K 3 You are evaluating two mutually exclusive projects, A and B The cash flows are below What is the IRR for each project! What is the crossover rate for these projects! Which project is acceptable if the appropriate discount rate a 5 percent? What if the rate it is percent? 20 11 Is there arning conflict for these two project! Wover what range of rites is there a conflict 3 Drow the NPV Profile including all projects. Use the given range for the interest rate S 7 isputs The 9 0 1 2 O Confia Convert Accept Acable 15 C10 2 Epla + A -31000000 SIZS DOO $10.000 $115.000 $140.000 S145.000 S150.000 5155.000 5160.000 315.000 5179 300 5100 52100 51 400.000 $170.00 $200.000 5210 DOO $235.000 5235.000 $20.000 5250.300 525.00 5275.000 52500 $225.000 50 5175.000 5150 000 3175.000 10 11 33 S. 15 ** wing as Table Styles D G K 3 You are evaluating two mutually exclusive projects, A and B The cash flows are below What is the IRR for each project! What is the crossover rate for these projects! Which project is acceptable if the appropriate discount rate a 5 percent? What if the rate it is percent? 20 11 Is there arning conflict for these two project! Wover what range of rites is there a conflict 3 Drow the NPV Profile including all projects. Use the given range for the interest rate S 7 isputs The 9 0 1 2 O Confia Convert Accept Acable 15 C10 2 Epla + A -31000000 SIZS DOO $10.000 $115.000 $140.000 S145.000 S150.000 5155.000 5160.000 315.000 5179 300 5100 52100 51 400.000 $170.00 $200.000 5210 DOO $235.000 5235.000 $20.000 5250.300 525.00 5275.000 52500 $225.000 50 5175.000 5150 000 3175.000 10 11 33 S. 15 **

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts