Question: Winnipeg Development Corp. (WDC) was contracted to construct a new hospital for $1.82 billion. The hospital is located on government land and therefore owned by

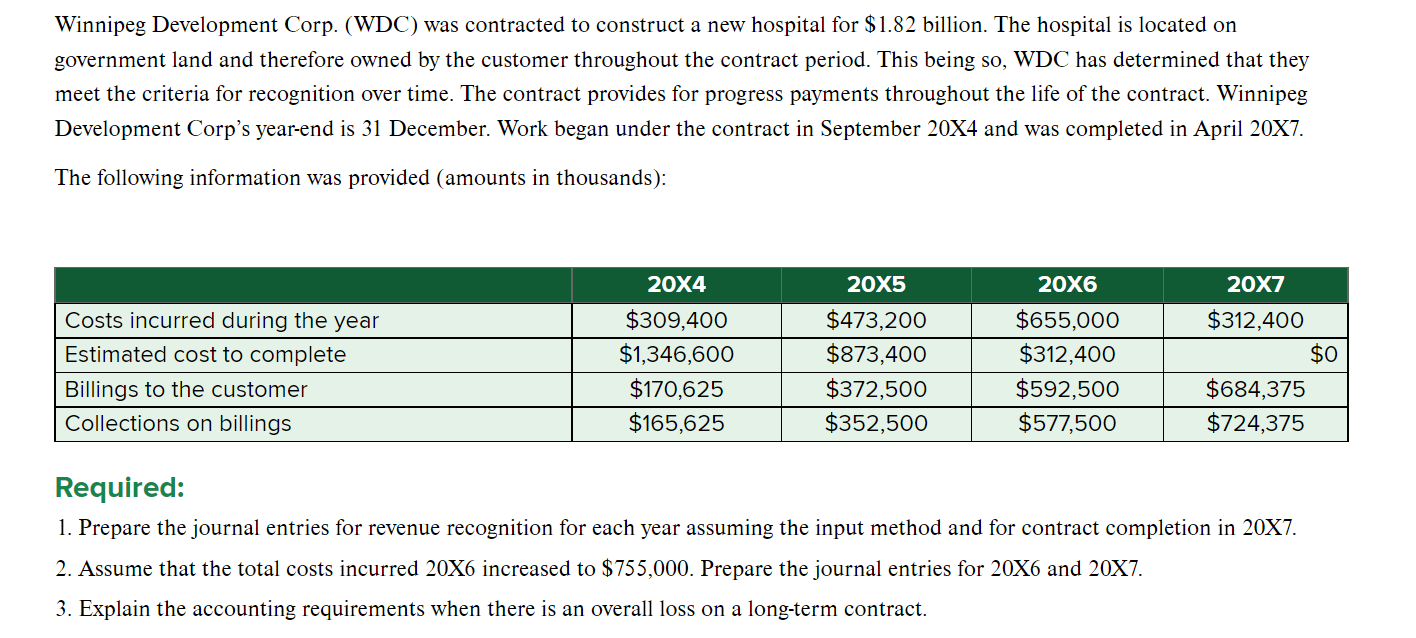

Winnipeg Development Corp. (WDC) was contracted to construct a new hospital for $1.82 billion. The hospital is located on government land and therefore owned by the customer throughout the contract period. This being so, WDC has determined that they meet the criteria for recognition over time. The contract provides for progress payments throughout the life of the contract. Winnipeg Development Corp's year-end is 31 December. Work began under the contract in September 20X4 and was completed in April 20X7. The following information was provided (amounts in thousands): Required: 1. Prepare the journal entries for revenue recognition for each year assuming the input method and for contract completion in 207. 2. Assume that the total costs incurred 206 increased to $755,000. Prepare the journal entries for 206 and 207. 3. Explain the accounting requirements when there is an overall loss on a long-term contract. Winnipeg Development Corp. (WDC) was contracted to construct a new hospital for $1.82 billion. The hospital is located on government land and therefore owned by the customer throughout the contract period. This being so, WDC has determined that they meet the criteria for recognition over time. The contract provides for progress payments throughout the life of the contract. Winnipeg Development Corp's year-end is 31 December. Work began under the contract in September 20X4 and was completed in April 20X7. The following information was provided (amounts in thousands): Required: 1. Prepare the journal entries for revenue recognition for each year assuming the input method and for contract completion in 207. 2. Assume that the total costs incurred 206 increased to $755,000. Prepare the journal entries for 206 and 207. 3. Explain the accounting requirements when there is an overall loss on a long-term contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts