Question: Winston Co. had two products code named X and Y. The firm had the following budget for August: Sales Variable costs Contribution Margin Fixed costs

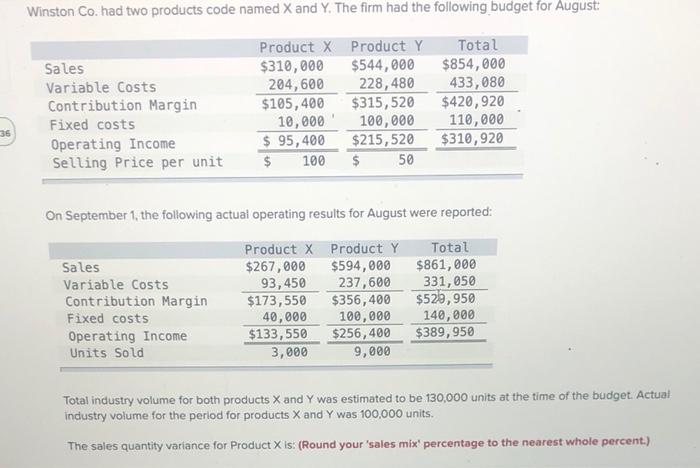

Winston Co. had two products code named X and Y. The firm had the following budget for August: Sales Variable costs Contribution Margin Fixed costs Operating Income Selling Price per unit Product X Product Y $310,000 $544,000 204,600 228,480 $105,400 $315,520 10,000 100,000 $ 95,400 $215,520 $ 100 $ 50 Total $854,000 433,080 $420,920 110,000 $310,920 36 On September 1, the following actual operating results for August were reported: Sales Variable costs Contribution Margin Fixed costs Operating Income Units Sold Product X Product Y $267,000 $594,000 93,450 237,600 $173,550 $356,400 40,000 100,000 $133,550 $256,400 3,000 9,000 Total $861,000 331,050 $520,950 140,000 $389,950 Total industry volume for both products X and Y was estimated to be 130,000 units at the time of the budget. Actual industry volume for the period for products X and Y was 100,000 units. The sales quantity variance for Product X is: (Round your 'sales mix' percentage to the nearest whole percent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts