Question: WinTech Technology Inc. is evaluating two financing options for its new investment of $2,500,000. Option 1: 0% debt Option 2: 60% debt Regardless of

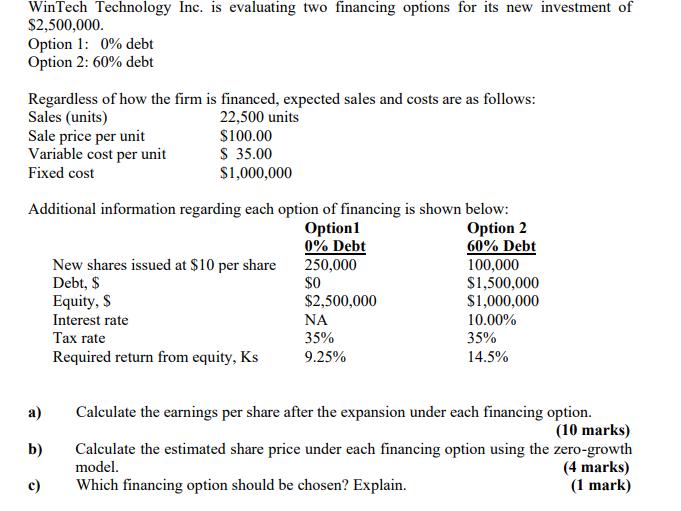

WinTech Technology Inc. is evaluating two financing options for its new investment of $2,500,000. Option 1: 0% debt Option 2: 60% debt Regardless of how the firm is financed, expected sales and costs are as follows: Sales (units) 22,500 units Sale price per unit Variable cost per unit Fixed cost $100.00 $ 35.00 $1,000,000 Additional information regarding each option of financing is shown below: Option1 0% Debt Option 2 60% Debt 100,000 $1,500,000 250,000 $0 $2,500,000 $1,000,000 10.00% 35% 35% 9.25% 14.5% a) b) c) New shares issued at $10 per share Debt, $ Equity, S Interest rate Tax rate Required return from equity, Ks Calculate the earnings per share after the expansion under each financing option. (10 marks) Calculate the estimated share price under each financing option using the zero-growth model. (4 marks) Which financing option should be chosen? Explain. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Lets solve this problem step by step a Earnings per share EPS after expansion under each financing o... View full answer

Get step-by-step solutions from verified subject matter experts