Question: With 33.33% probability, cash flows (EBIT) are $7,500. However, with 33.33% probability there can be a recession in which EBIT is $2,500. With 33.33% probability,

With 33.33% probability, cash flows (EBIT) are $7,500. However, with 33.33% probability there can be a recession in which EBIT is $2,500. With 33.33% probability, there can be an expansion in which EBIT is $12,500.

Question 1:

A. Plot a line for ROE against EBIT for the current and proposed capital structures. Based on your chart, at what point do the two lines cross (i.e. at what level of EBIT is ROE under the current capital structure equal to ROE under the proposed capital structure)?

B. Derive an algebraic expression for the level of EBIT at which the two lines intersect in the Figure you created in Question 4.

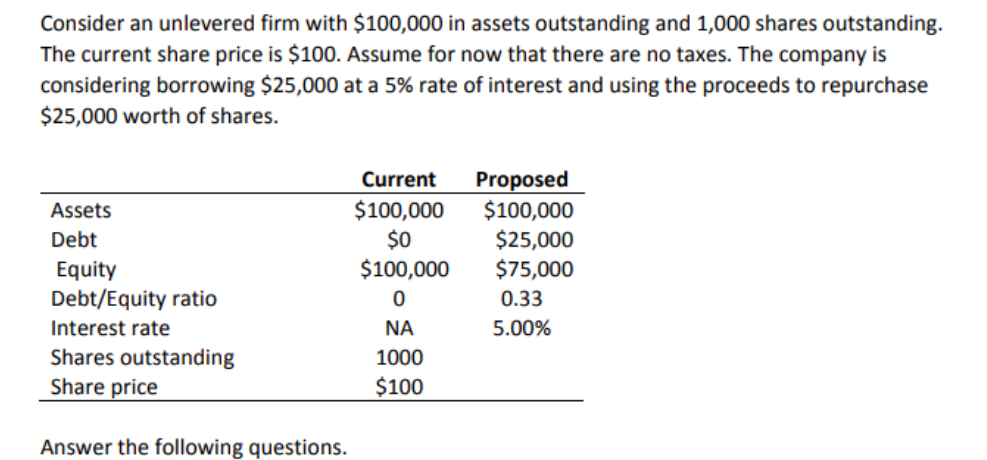

Consider an unlevered firm with $100,000 in assets outstanding and 1,000 shares outstanding. The current share price is $100. Assume for now that there are no taxes. The company is considering borrowing $25,000 at a 5% rate of interest and using the proceeds to repurchase $25,000 worth of shares. Current Proposed $100,000 $100,000 $25,000 100,000 $75,000 Assets Debt Equity Debt/Equity ratio Interest rate Shares outstanding Share price S0 0.33 5.00% 0 NA 1000 $100 Answer the following questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts