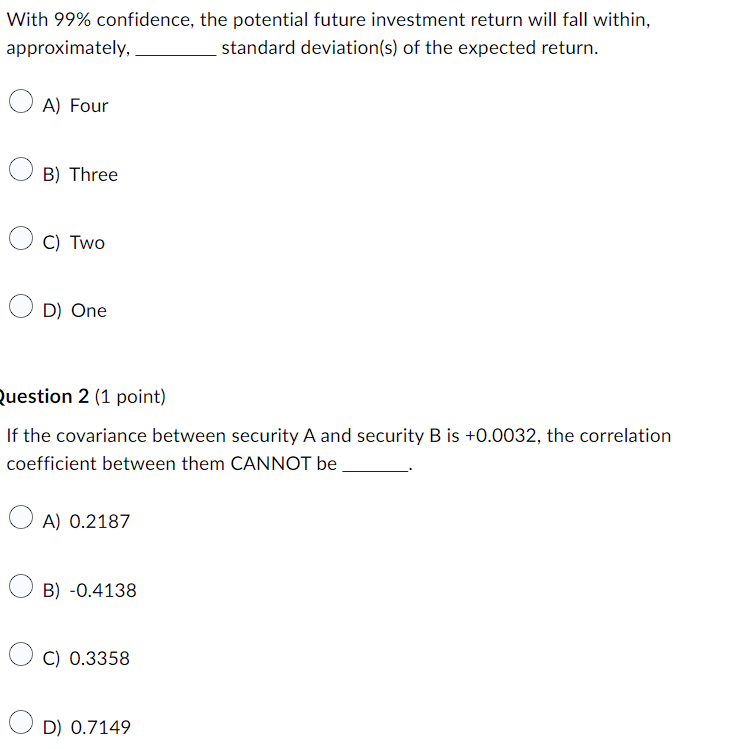

Question: With 99% confidence, the potential future investment return will fall within, approximately, standard deviation(s) of the expected return. A) Four B) Three C) Two D)

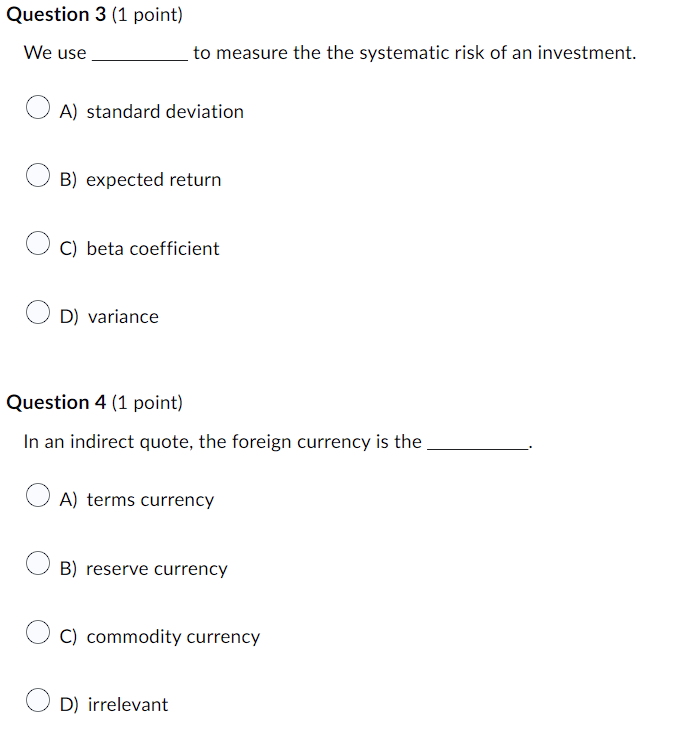

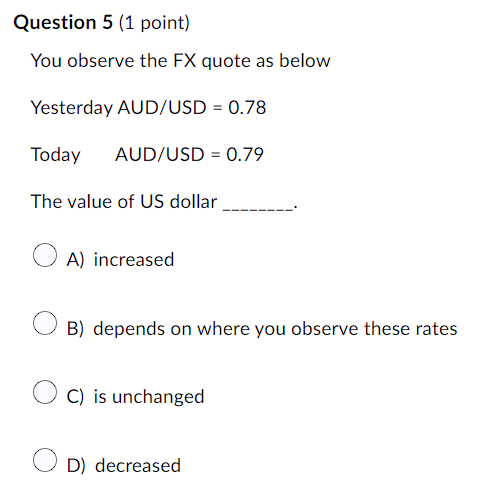

With 99% confidence, the potential future investment return will fall within, approximately, standard deviation(s) of the expected return. A) Four B) Three C) Two D) One uestion 2 (1 point) If the covariance between security A and security B is +0.0032, the correlation coefficient between them CANNOT be A) 0.2187 B) 0.4138 C) 0.3358 D) 0.7149 We use to measure the the systematic risk of an investment. A) standard deviation B) expected return C) beta coefficient D) variance Question 4 (1 point) In an indirect quote, the foreign currency is the A) terms currency B) reserve currency C) commodity currency D) irrelevant Question 5 (1 point) You observe the FX quote as below Yesterday AUD/USD =0.78 Today AUD/USD =0.79 The value of US dollar A) increased B) depends on where you observe these rates C) is unchanged D) decreased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts