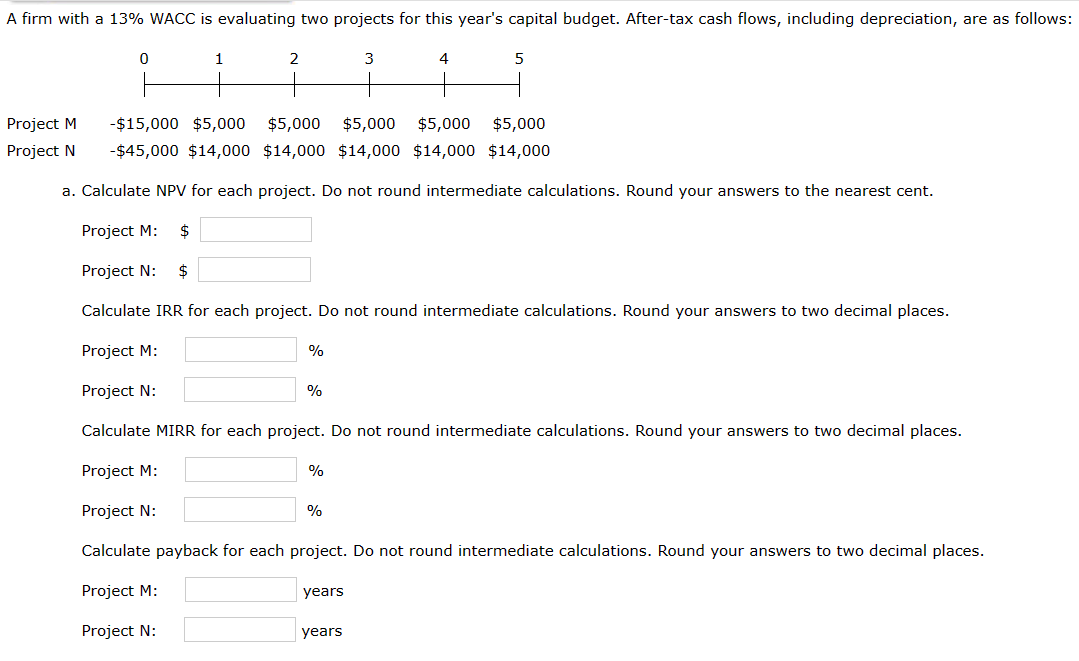

Question: with a 13% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follow a. Calculate NPV for

with a 13% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follow a. Calculate NPV for each project. Do not round intermediate calculations. Round your answers to the nearest cent. Project M: $ Project N: $ Calculate IRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: % Project N: % Calculate MIRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: % Project N: % Calculate payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: years Project N: years Calculate discounted payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: years Project N: years b. Assuming the projects are independent, which one(s) would you recommend? c. If the projects are mutually exclusive, which would you recommend? with a 13% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follow a. Calculate NPV for each project. Do not round intermediate calculations. Round your answers to the nearest cent. Project M: $ Project N: $ Calculate IRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: % Project N: % Calculate MIRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: % Project N: % Calculate payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: years Project N: years Calculate discounted payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: years Project N: years b. Assuming the projects are independent, which one(s) would you recommend? c. If the projects are mutually exclusive, which would you recommend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts