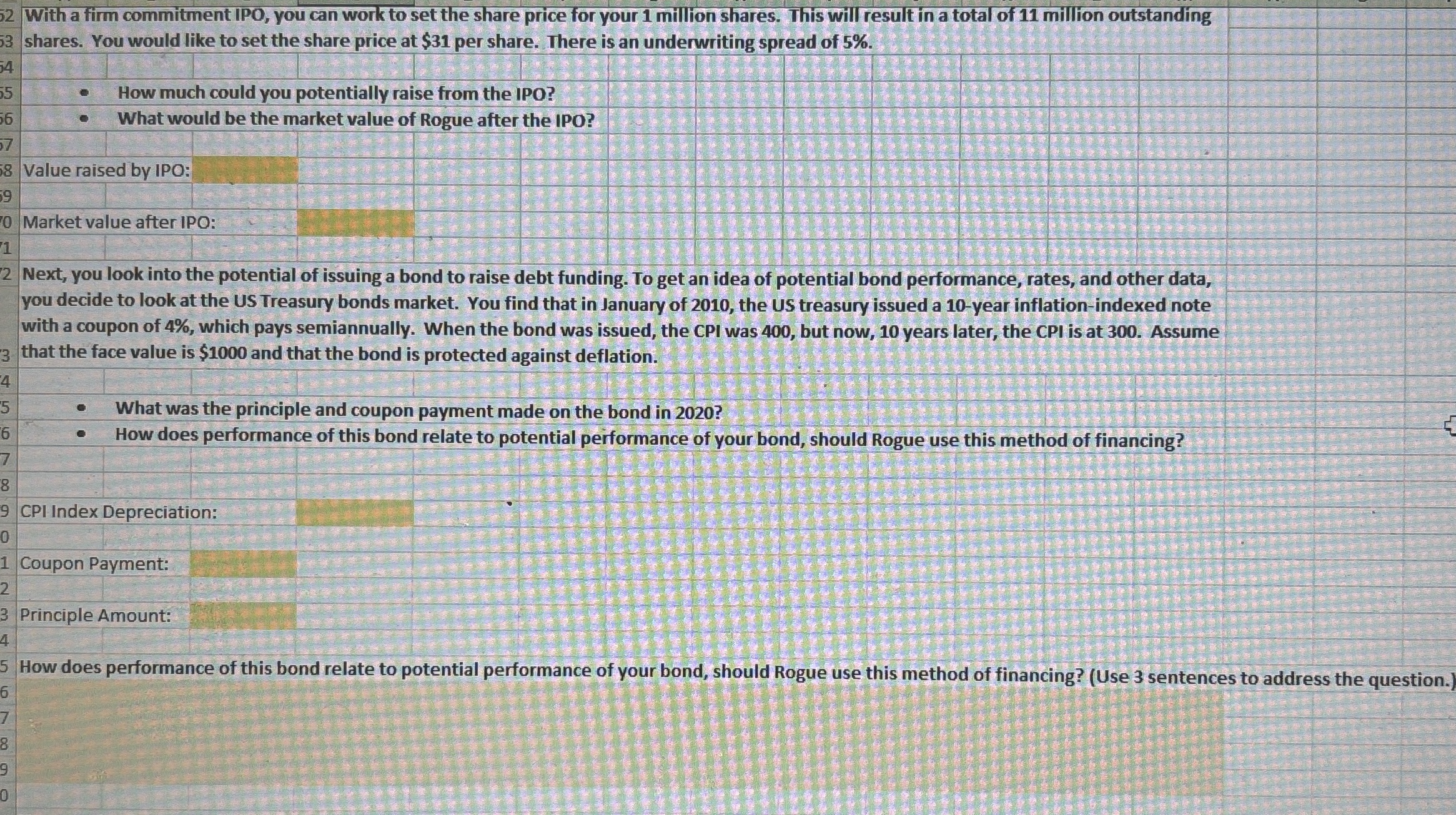

Question: With a firm commitment IPO, you can work to set the share price for your 1 million shares. This will result in a total of

With a firm commitment IPO, you can work to set the share price for your million shares. This will result in a total of million outstanding shares. You would like to set the share price at $ per share. There is an underwriting spread of

Next, you look into the potential of issuing a bond to raise debt funding. To get an idea of potential bond performance, rates, and other data, you decide to look at the US Treasury bonds market. You find that in January of the US treasury issued a year inflationindexed note with a coupon of which pays semiannually. When the bond was issued, the CPI was but now, years later, the CPI is at Assume that the face value is $ and that the bond is protected against deflation.

What was the principle and coupon payment made on the bond in

How does performance of this bond relate to potential performance of your bond, should Rogue use this method of financing?

CPI Index Depreciation:

Coupon Payment:

Principle Amount:

How does performance of this bond relate to potential performance of your bond, should Rogue use this method of financing? Use sentences to address the question.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock