Question: With all other variables being equal, the Freight Forwarding Quotation for a High-Value Shipment will be: Higher than a quotation for a Low-Value Shipment Value

With all other variables being equal, the Freight Forwarding Quotation for a High-Value Shipment will be:

Higher than a quotation for a Low-Value Shipment

Value of goods has no influence on the Freight Forwarder's Quotation

Lower than a quotation for a Low-Value Shipment

None of the listed answers are correct

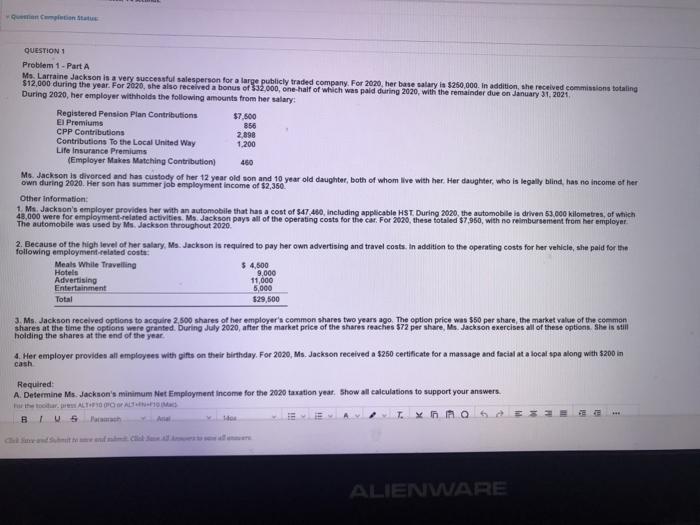

Queen Can QUESTION 1 Problem 1 - Part A Ms Larraine Jackson is a very successful salesperson for a large publicly traded company. For 2020, her base salary is $250.000. In addition, she received commissions totaling $12,000 during the year. For 2020, she also received a bonus of $12.000, one-half of which was paid during 2020, with the remainder due on January 31, 2021 During 2020, her employer withholds the following amounts from her salary: Registered Pension Plan Contributions $7,500 El Premiums 856 CPP Contributions 2,898 Contributions to the Local United Way 1.200 Life Insurance Premiums (Employer Makes Matching Contribution) 460 Mo. Jackson is divorced and has custody of her 12 year old son and 10 year old daughter, both of whom live with her. Her daughter, who is legally blind, has no income of her own during 2020. Her son has summer job employment income of $2,360. Other information: 1. Ms Jackson's employer provides her with an automobile that has a cost of $47.410, including applicable HST. During 2020, the automobile is driven 53.000 kilometres, of which 48,000 were for employment-related activities. Mo, Jackson pays all of the operating costs for the car. For 2020, these totaled $7,960, with no reimbursement from her employer The automobile was used by Ms. Jackson throughout 2020, 2. Because of the high level of her salary, Ms. Jackson is required to pay her own advertising and travel costs. In addition to the operating costs for her vehicle, she paid for the following employment related costs Meals While Travelling $ 4,500 Hotels 9,000 Advertising 11,000 Entertainment 5000 Total 529,500 3. Ms. Jackson received options to acquire 2.500 shares of her employer's common shares two years ago. The option price was $50 per share the market value of the common shares at the time the options were granted. During July 2020, after the market price of the shares reaches $72 per share, Ms. Jackson exercises all of these options. She is still holding the shares at the end of the year 4. Her employer provides all employees with gifts on their birthday. For 2020, Ms. Jackson received a $250 certificate for a message and facial at a local apa along with $200 in cash Required A. Determine Ms. Jackson's minimum Net Employment Income for the 2020 taxation year. Show all calculations to support your answers. horren ALTO SAM BI W Sush Txnn6E ALIENWARE