Question: with clear and detailed calculation working presented. QUESTION 3 The price of the share is $20 today and the interest rate is 10% compounded continuously.

with clear and detailed calculation working presented.

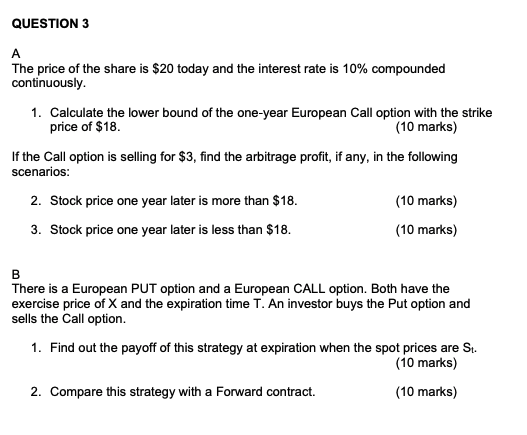

QUESTION 3 The price of the share is $20 today and the interest rate is 10% compounded continuously. 1. Calculate the lower bound of the one-year European Call option with the strike price of $18. (10 marks) If the Call option is selling for $3, find the arbitrage profit, if any, in the following scenarios: 2. Stock price one year later is more than $18. (10 marks) 3. Stock price one year later is less than $18. (10 marks) B There is a European PUT option and a European CALL option. Both have the exercise price of X and the expiration time T. An investor buys the Put option and sells the Call option. 1. Find out the payoff of this strategy at expiration when the spot prices are St. (10 marks) 2. Compare this strategy with a Forward contract. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts