Question: With complete solutions. Typewritten is better. 1. (2 pts) Find the present and future value of a constant income flow of Php 100,000 per year

With complete solutions. Typewritten is better.

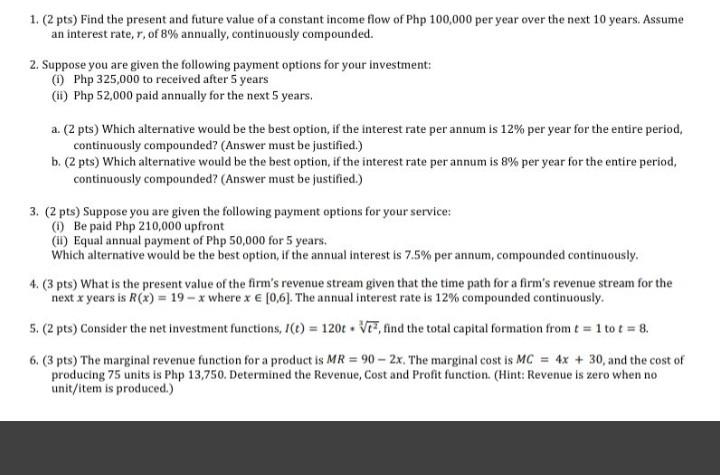

1. (2 pts) Find the present and future value of a constant income flow of Php 100,000 per year over the next 10 years. Assume an interest rate, r, of 8% annually, continuously compounded. 2. Suppose you are given the following payment options for your investment: 0 Php 325,000 to received after 5 years (ii) Php 52,000 paid annually for the next 5 years, a. (2 pts) Which alternative would be the best option, if the interest rate per annum is 12% per year for the entire period, continuously compounded? (Answer must be justified.) b. (2 pts) Which alternative would be the best option, if the interest rate per annum is 8% per year for the entire period, continuously compounded? (Answer must be justified.) 3. (2 pts) Suppose you are given the following payment options for your service: (1) Be paid Php 210,000 upfront (II) Equal annual payment of Php 50,000 for 5 years. Which alternative would be the best option, if the annual interest is 7.5% per annum, compounded continuously. 4. (3 pts) What is the present value of the firm's revenue stream given that the time path for a firm's revenue stream for the next x years is R(x) = 19 - x where x (0,6]. The annual interest rate is 12% compounded continuously. 5. (2 pts) Consider the net investment functions, 1(t) = 120 Ve, find the total capital formation from t = 1 to t = 8. 6. (3 pts) The marginal revenue function for a product is MR = 90 - 2x. The marginal cost is MC = 4x + 30, and the cost of producing 75 units is Php 13,750. Determined the Revenue, Cost and Profit function. (Hint: Revenue is zero when no unit/item is produced.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts