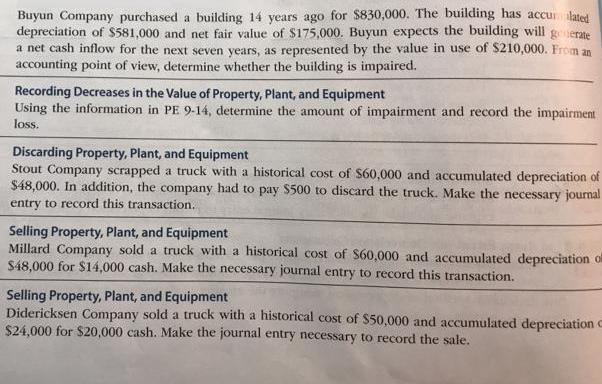

Question: Buyun Company purchased a building 14 years ago for $830,000. The building has accu lated depreciation of S581,000 and net fair value of $175,000.

Buyun Company purchased a building 14 years ago for $830,000. The building has accu lated depreciation of S581,000 and net fair value of $175,000. Buyun expects the building will geerate a net cash inflow for the next seven years, as represented by the value in use of S210,000. From an accounting point of view, determine whether the building is impaired. Recording Decreases in the Value of Property, Plant, and Equipment Using the information in PE 9-14, determine the amount of impairment and record the impairment loss. Discarding Property, Plant, and Equipment Stout Company scrapped a truck with a historical cost of S60,000 and accumulated depreciation of $48,000. In addition, the company had to pay $500 to discard the truck. Make the necessary journal entry to record this transaction. Selling Property, Plant, and Equipment Millard Company sold a truck with a historical cost of S60,000 and accumulated depreciation ol $48,000 for $14,000 cash. Make the necessary journal entry to record this transaction. Selling Property, Plant, and Equipment Didericksen Company sold a truck with a historical cost of $50,000 and accumulated depreciation C $24,000 for $20,000 cash. Make the journal entry necessary to record the sale.

Step by Step Solution

There are 3 Steps involved in it

PE 914 Book value of the asset 830000581000 249000 Undiscounted expe... View full answer

Get step-by-step solutions from verified subject matter experts