Question: WITH FORMULA Calibri 11 % Paste B I Cells Editing Alignment Number Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A1 v B

WITH FORMULA

WITH FORMULA

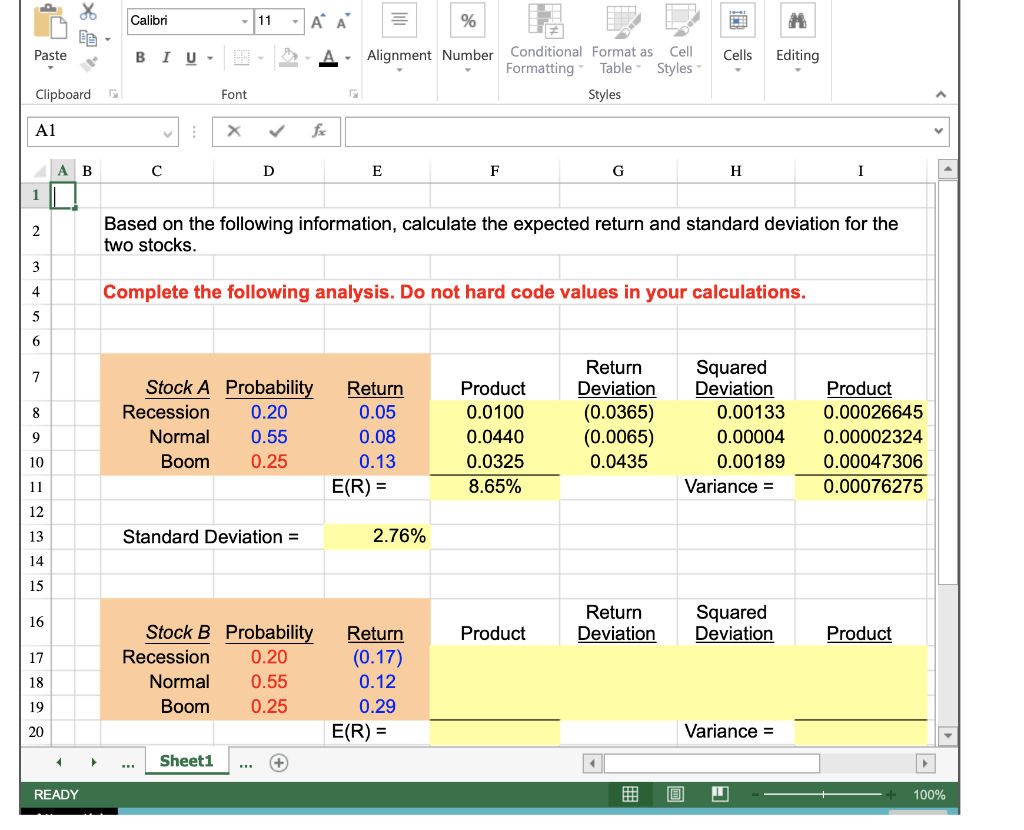

Calibri 11 % Paste B I Cells Editing Alignment Number Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A1 v B D E F G H I 1 2 Based on the following information, calculate the expected return and standard deviation for the two stocks. 3 4 Complete the following analysis. Do not hard code values in your calculations. 5 6 7 8 Stock A Probability Recession 0.20 Normal 0.55 Boom 0.25 Return 0.05 0.08 0.13 E(R) = Return Deviation (0.0365) (0.0065) 0.0435 Product 0.0100 0.0440 0.0325 8.65% 9 Squared Deviation 0.00133 0.00004 0.00189 Variance = Product 0.00026645 0.00002324 0.00047306 0.00076275 10 11 12 13 Standard Deviation = 2.76% 14 15 16 Product Return Deviation Squared Deviation Product 17 Stock B Probability Recession 0.20 Normal 0.55 Boom 0.25 18 Return (0.17) 0.12 0.29 E(R) = 19 20 Variance = Sheet1 READY 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts