Question: with full calculation You manage a U.S. core equity portfolio that is sector-neutral to the S&P500 Ondex (its industry sector weights approximately match the S&P

with full calculation

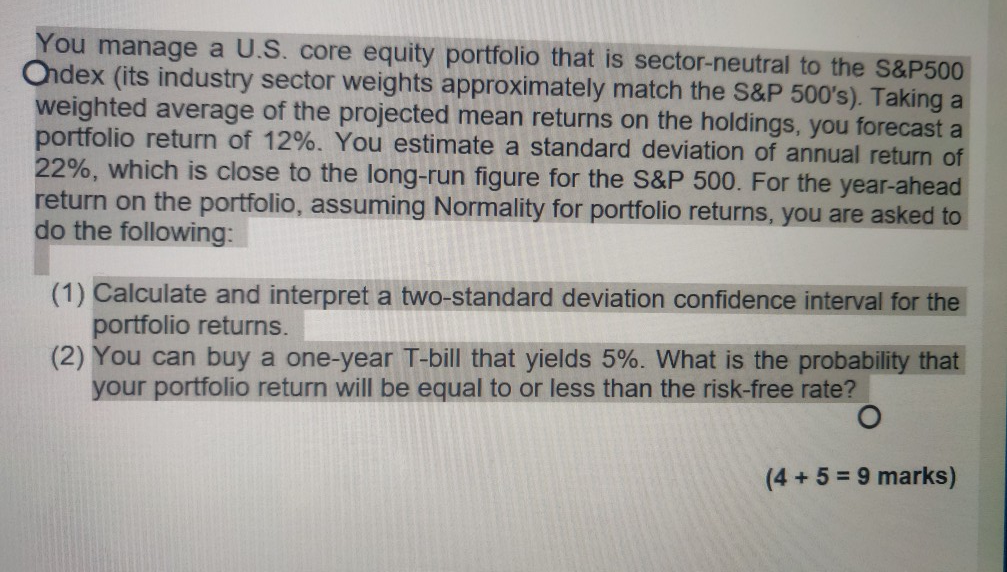

You manage a U.S. core equity portfolio that is sector-neutral to the S&P500 Ondex (its industry sector weights approximately match the S&P 500's). Taking a weighted average of the projected mean returns on the holdings, you forecast a portfolio return of 12%. You estimate a standard deviation of annual return of 22%, which is close to the long-run figure for the S&P 500. For the year-ahead return on the portfolio, assuming Normality for portfolio returns, you are asked to do the following: (1) Calculate and interpret a two-standard deviation confidence interval for the portfolio returns. (2) You can buy a one-year T-bill that yields 5%. What is the probability that your portfolio return will be equal to or less than the risk-free rate? (4 + 5 = 9 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts