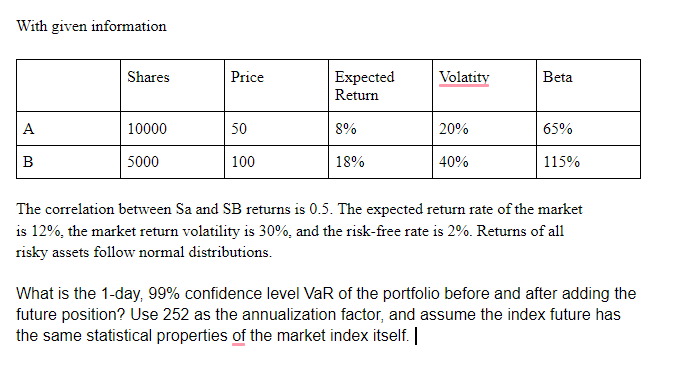

Question: With given information Shares Price Volatity Beta Expected Return A 10000 50 8% 20% 65% B 5000 100 18% 40% 115% The correlation between Sa

With given information Shares Price Volatity Beta Expected Return A 10000 50 8% 20% 65% B 5000 100 18% 40% 115% The correlation between Sa and SB returns is 0.5. The expected return rate of the market is 12%, the market return volatility is 30%, and the risk-free rate is 2%. Returns of all risky assets follow normal distributions. What is the 1-day, 99% confidence level VaR of the portfolio before and after adding the future position? Use 252 as the annualization factor, and assume the index future has the same statistical properties of the market index itself.|| With given information Shares Price Volatity Beta Expected Return A 10000 50 8% 20% 65% B 5000 100 18% 40% 115% The correlation between Sa and SB returns is 0.5. The expected return rate of the market is 12%, the market return volatility is 30%, and the risk-free rate is 2%. Returns of all risky assets follow normal distributions. What is the 1-day, 99% confidence level VaR of the portfolio before and after adding the future position? Use 252 as the annualization factor, and assume the index future has the same statistical properties of the market index itself.||

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts