Question: with i = 1,..., n, and new (ST) = Prove that, for the special case where (ST) = (ST Ki)+, - (STK) with K

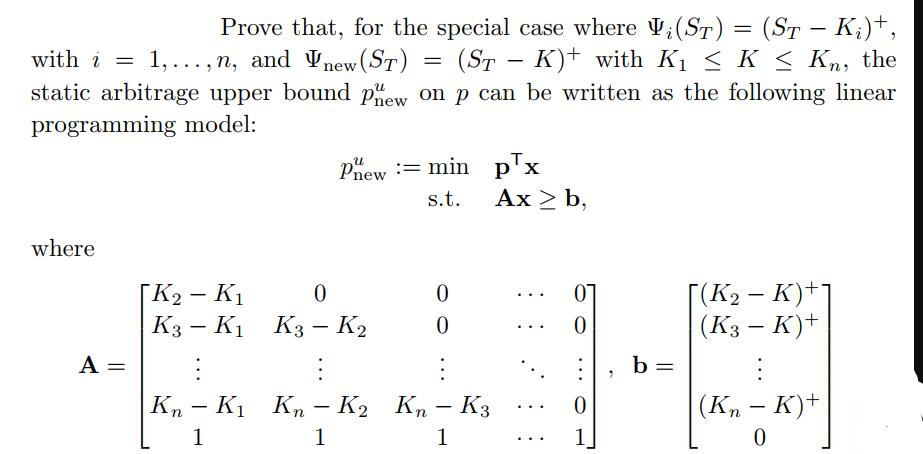

with i = 1,..., n, and new (ST) = Prove that, for the special case where (ST) = (ST Ki)+, - (STK) with K K Kn, the static arbitrage upper bound pew on p can be written as the following linear programming model: Pnew := min pTx s.t. Ax > b, where K2 - K 0 0 0 [(K2 K)+ - K3-K1 - K3 K 0 0 A = Kn-K Kn - K 1 1 Kn - K3 1 0 1 " b = (K3 - K)+ (Kn - K)+ 0 In words, the first condition states that the price of the new derivative has to be at least as large as the price of any sub-replicating portfolio of the old securities. Likewise, the second condition states that the price of the new derivative has to be at most as large as the price of any super-replicating portfolio of the old securities. The above two conditions automatically yield the following static arbitrage bounds on p. Lower bound: Pnew max px Upper bound: s.t. Vnew (ST)*(ST) for all ST 0. Pnew min pTx s.t. Vnew (ST) * (ST) for all ST 0. The piecewise linearity of new (ST) and V(ST), i = 1,...,n, implies that both inequalities new (ST) *(ST) for all ST 0, and new (ST) *(ST) for all ST 0 can be formulated as a finite system of linear inequalities. Therefore, both the upper and lower static arbitrage bounds can be formulated as linear pro- gramming models. In particular, for the special case where V(ST) = (STK;)+, for i = 1,...,n, and new (ST) = (ST - K)+ with K k Kn the static arbi- trage upper bound pew on p can be written as the following linear programming model (Exercise 4.10): Pnew min pTx s.t. Ax > b, (4.8)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts