Question: with part a. Thanks. Required information Problem 10-65 (LO 10-3) (Static) [The following information applies to the questions displayed below.] Phil owns a ranch business

with part a. Thanks.

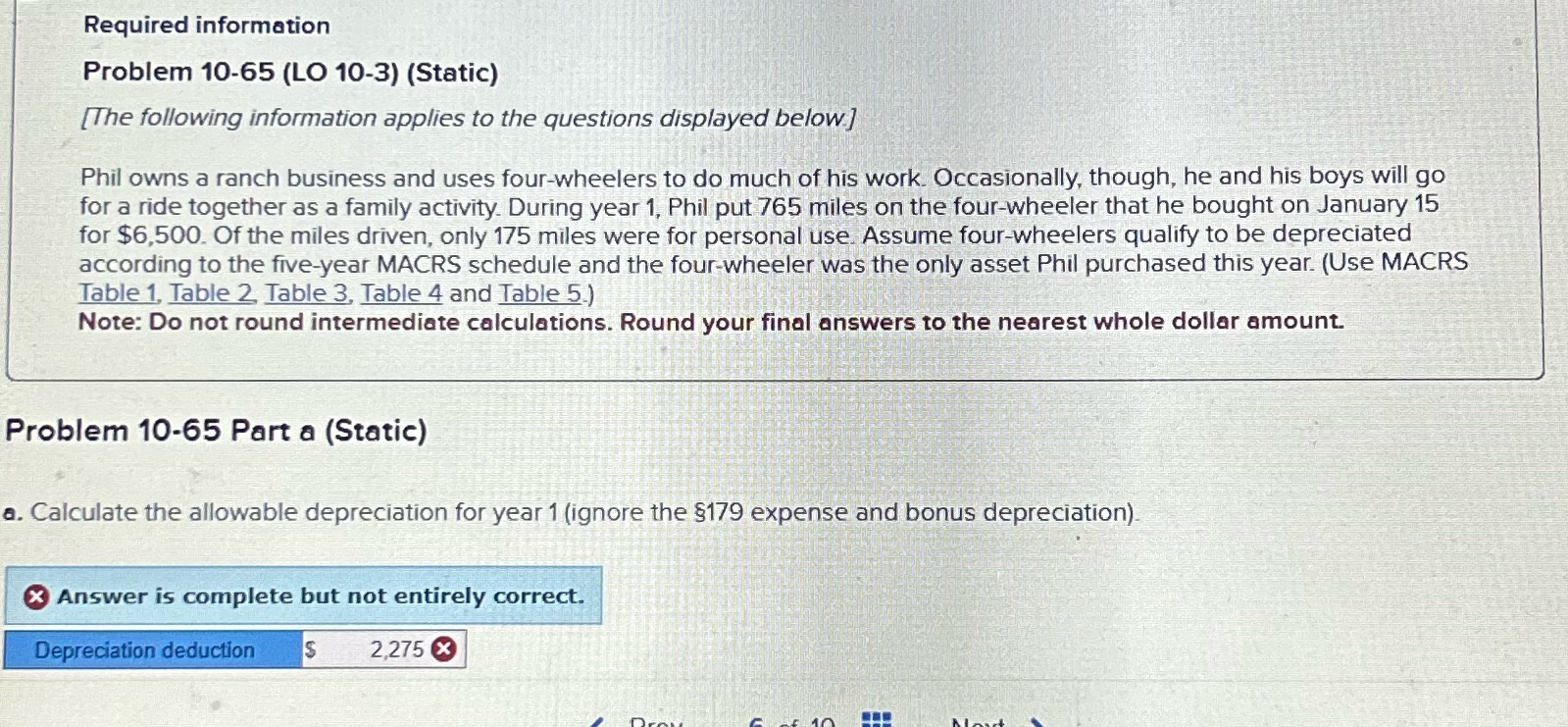

Required information Problem 10-65 (LO 10-3) (Static) [The following information applies to the questions displayed below.] Phil owns a ranch business and uses four-wheelers to do much of his work. Occasionally, though, he and his boys will go for a ride together as a family activity. During year 1, Phil put 765 miles on the four-wheeler that he bought on January 15 for $6,500. Of the miles driven, only 175 miles were for personal use. Assume four-wheelers qualify to be depreciated according to the five-year MACRS schedule and the four-wheeler was the only asset Phil purchased this year. (Use MACRS Table 1, Table 2 Table 3, Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Problem 10-65 Part a (Static) a. Calculate the allowable depreciation for year 1 (ignore the $179 expense and bonus depreciation) X Answer is complete but not entirely correct. Depreciation deduction IS 2,275 X

Required information Problem 10-65 (LO 10-3) (Static) [The following information applies to the questions displayed below.] Phil owns a ranch business and uses four-wheelers to do much of his work. Occasionally, though, he and his boys will go for a ride together as a family activity. During year 1, Phil put 765 miles on the four-wheeler that he bought on January 15 for $6,500. Of the miles driven, only 175 miles were for personal use. Assume four-wheelers qualify to be depreciated according to the five-year MACRS schedule and the four-wheeler was the only asset Phil purchased this year. (Use MACRS Table 1, Table 2 Table 3, Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Problem 10-65 Part a (Static) a. Calculate the allowable depreciation for year 1 (ignore the $179 expense and bonus depreciation) X Answer is complete but not entirely correct. Depreciation deduction IS 2,275 X

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock