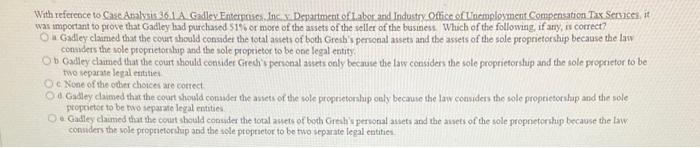

Question: With reference to Case Analysis 36.1A Gadley Enterposes. The y Desartment of Labor and Industry Office of Unemployment Compensation Tax Services, it was important to

With reference to Case Analysis 36.1A Gadley Enterposes. The y Desartment of Labor and Industry Office of Unemployment Compensation Tax Services, it was important to prove that Gadley had purchased 51% or more of the assets of the seller of the business Which of the following, if any, es correct? on Gadley claimed that the court should consider the total assets of both Greth's personal asets and the assets of the sole proprietorship because the law corders the sole proprietorship and the sole proprietor to be one legal entity Ob Gadley claimed that the court should consider Gresh's personal assets only because the law consider the sole proprietorship and the sole proprietor to be O e None of the other choices are correct & Gadley calmed that the court should consider the anets of the sole proprietorship only because the law considers the sole proprietorshup and the sole proprietor to be two separate legal entities D. Gadley claimed that the court should consider the total asets of both Gresh's personal assets and the assets of the sole propnetorship because the law connders the sole proprietorshup and the sole proprietor to be two separate legal entities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts