Question: With reference to the case, explain how stock-out can cause problems in a company to suffer losses? What other problems (costs) do you face for

- With reference to the case, explain how stock-out can cause problems in a company to suffer losses? What other problems (costs) do you face for not managing your Logistics and Supply Chain properly? (5)

- There are 4 various kinds of Logistics System, use examples from Bangladesh with each and every kind and explain each one of them. (4)

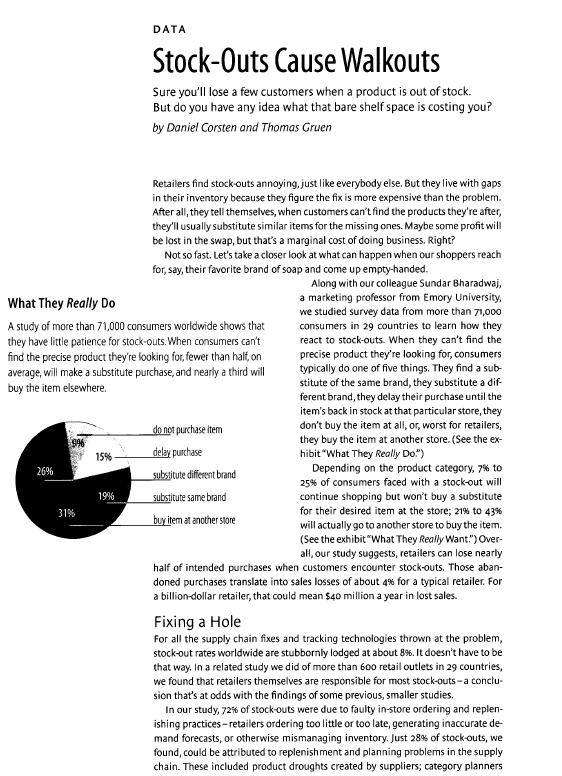

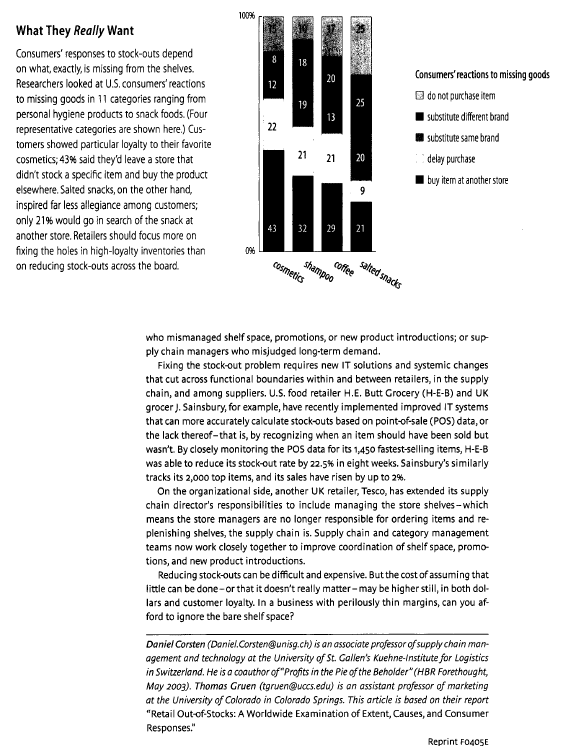

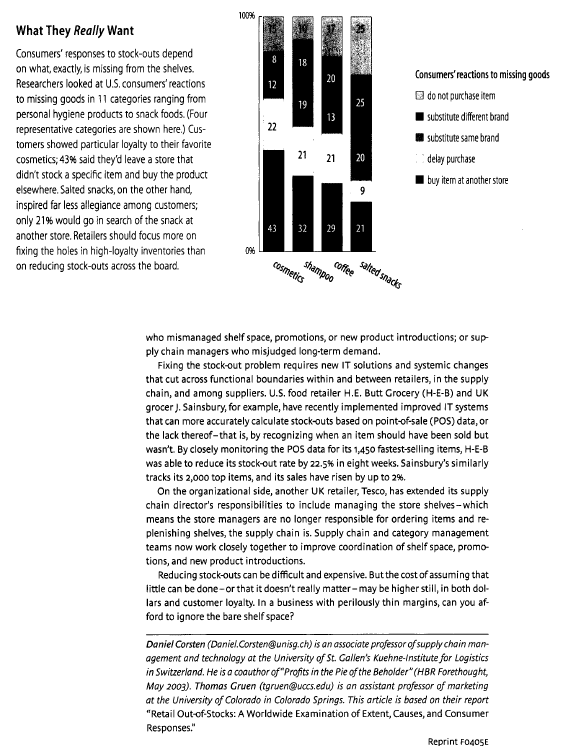

DATA Stock-Outs Cause Walkouts Sure you'll lose a few customers when a product is out of stock. But do you have any idea what that bare shelf space is costing you? by Daniel Corsten and Thomas Gruen Retailers find stock outs annoying, just like everybody else. But they live with gaps in their inventory because they figure the fix is more expensive than the problem. After all, they tell themselves, when customers can't find the products they're after, they'll usually substitute similar items for the missing ones. Maybe some profit will be lost in the swap, but that's a marginal cost of doing business. Right? Not so fast. Let's take a closer look at what can happen when our shoppers reach for, say, their favorite brand of soap and come up empty-handed. Along with our colleague Sundar Bharadwaj, What They Really DO a marketing professor from Emory University, we studied survey data from more than 71,000 A study of more than 71,000 consumers worldwide shows that consumers in 29 countries to learn how they they have little patience for stock-outs. When consumers can't react to stock-outs. When they can't find the find the precise product they're looking for, fewer than half, on precise product they're looking for, consumers average, will make a substitute purchase, and nearly a third will typically do one of five things. They find a sub- buy the item elsewhere. stitute of the same brand, they substitute a dif- ferent brand, they delay their purchase until the item's back in stock at that particular store, they do not purchase item don't buy the item at all, or worst for retailers, 996 they buy the item at another store. (See the ex- 15% delay purchase hibit"What They Really Do") 26% substitute different brand Depending on the product category, 7% to 25% of consumers faced with a stock-out will substitute same brand continue shopping but won't buy a substitute 31% for their desired item at the store; 21% to 43% buy item at another store will actually go to another store to buy the item. (See the exhibit "What They Really Want.") Over- all, our study suggests, retailers can lose nearly half of intended purchases when customers encounter stockouts. Those aban- doned purchases translate into sales losses of about 4% for a typical retailer. For a billion dollar retailer, that could mean $40 million a year in lost sales. Fixing a Hole For all the supply chain fixes and tracking technologies thrown at the problem, stock-out rates worldwide are stubbornly lodged at about 8%. It doesn't have to be that way. In a related study we did of more than 600 retail outlets in 29 countries, we found that retailers themselves are responsible for most stock-outs-a conclu- sion that's at odds with the findings of some previous, smaller studies. In our study, 72% of stockouts were due to faulty in-store ordering and replen- ishing practices-retailers ordering too little or too late, generating inaccurate de mand forecasts, or otherwise mismanaging inventory. Just 28% of stock outs, we found, could be attributed to replenishment and planning problems in the supply chain. These included product droughts created by suppliers; category planners 19% 100% 8 18 20 12 19 25 22 What They Really Want Consumers' responses to stock-outs depend on what exactly, is missing from the shelves. Researchers looked at U.S.consumers' reactions to missing goods in 11 categories ranging from personal hygiene products to snack foods. (Four representative categories are shown here.) Cus- tomers showed particular loyalty to their favorite cosmetics: 43% said they'd leave a store that didn't stock a specific item and buy the product elsewhere. Salted snacks, on the other hand, inspired far less allegiance among customers only 21% would go in search of the snack at another store. Retailers should focus more on fixing the holes in high-loyalty inventories than on reducing stock-outs across the board. Consumers' reactions to missing goods do not purchase item substitute different brand substitute same brand delay purchase I buy item at another store 21 21 20 9 43 32 29 21 salted snacks coffee shampoo Cosmetics who mismanaged shelf space, promotions, or new product introductions; or sup ply chain managers who misjudged long-term demand. Fixing the stock-out problem requires new IT solutions and systemic changes that cut across functional boundaries within and between retailers, in the supply chain, and among suppliers. U.S.food retailer H.E. Butt Grocery (H-E-B) and UK grocer). Sainsbury, for example, have recently implemented improved IT systems that can more accurately calculate stock outs based on point-of-sale (POS) data, or the lack thereof-that is, by recognizing when an item should have been sold but wasn't. By closely monitoring the POS data for its 1,450 fastest-selling items, H-E-B was able to reduce its stock-out rate by 22.5% in eight weeks. Sainsbury's similarly tracks its 2,000 top items, and its sales have risen by up to 2%. On the organizational side, another UK retailer, Tesco, has extended its supply chain director's responsibilities to include managing the store shelves which means the store managers are no longer responsible for ordering items and re- plenishing shelves, the supply chain is. Supply chain and category management teams now work closely together to improve coordination of shelf space, promo- tions, and new product introductions. Reducing stock-outs can be difficult and expensive. But the cost of assuming that little can be done or that it doesn't really matter-may be higher still, in both dol- lars and customer loyalty. In a business with perilously thin margins, can you af- ford to ignore the bare shelf space? Daniel Corsten (Daniel Corsten@unisg.ch) is an associate professor of supply chain man- agement and technology at the University of St. Gallen's Kuehne-Institute for Logistics in Switzerland. He is a coauthor of "Profits in the Pie of the Beholder" (HBR Forethought, May 2003). Thomas Gruen (tgruen@uccs.edu) is an assistant professor of marketing at the University of Colorado in Colorado Springs. This article is based on their report "Retail Out of-Stocks: A Worldwide Examination of Extent, Causes, and Consumer Responses." Reprint F04OSE Harvard Business Review Notice of Use Restrictions, May 2009 Harvard Business Review and Harvard Business Publishing Newsletter content on EBSCOhost is licensed for the private individual use of authorized EBSCOhost users. It is not intended for use as assigned course material in academic institutions nor as corporate learning or training materials in businesses. Academic licensees may not use this content in electronic reserves, electronic course packs, persistent linking from syllabi or by any other means of incorporating the content into course resources. Business licensees may not host this content on learning management systems or use persistent linking or other means to incorporate the content into learning management systems. Harvard Business Publishing will be pleased to grant permission to make this content available through such means. For rates and permission, contact permissions@harvardbusiness.org