Question: with solution Problem 1 Trading Securities | At December 31, 2017 BAGCPARS Company properly reported the following Trading securities: Market Cost Value EDA Corp., 1,000

with solution

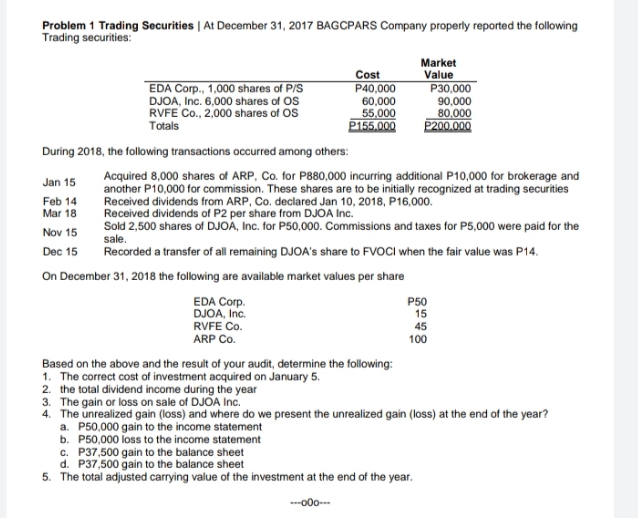

Problem 1 Trading Securities | At December 31, 2017 BAGCPARS Company properly reported the following Trading securities: Market Cost Value EDA Corp., 1,000 shares of P/S P40,000 P30,000 DJOA, Inc. 6,000 shares of OS 60,000 90,000 RVFE Co., 2,000 shares of OS 55,000 80,000 Totals P155.000 P200.000 During 2018, the following transactions occurred among others: Jan 15 Acquired 8,000 shares of ARP, Co. for P880,000 incurring additional P10,000 for brokerage and another P10,000 for commission. These shares are to be initially recognized at trading securities Feb 14 Received dividends from ARP, Co. declared Jan 10, 2018, P16,000. Mar 18 Received dividends of P2 per share from DJOA Inc. Nov 15 Sold 2,500 shares of DJOA, Inc. for P50,000. Commissions and taxes for P5,000 were paid for the sale. Dec 15 Recorded a transfer of all remaining DJOA's share to FVOCI when the fair value was P14. On December 31, 2018 the following are available market values per share EDA Corp. P50 DJOA, Inc. 15 RVFE Co. 45 ARP Co. 100 Based on the above and the result of your audit, determine the following: 1. The correct cost of investment acquired on January 5. 2. the total dividend income during the year 3. The gain or loss on sale of DJOA Inc. 4. The unrealized gain (loss) and where do we present the unrealized gain (loss) at the end of the year? a. P50,000 gain to the income statement b. P50,000 loss to the income statement c. P37,500 gain to the balance sheet d. P37,500 gain to the balance sheet 5. The total adjusted carrying value of the investment at the end of the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts