Question: With solutions please 106) Open-end mutual funds differ from elosed-end funds in that: A) open-end funds stand ready to redeem their shares, while closed-end funds

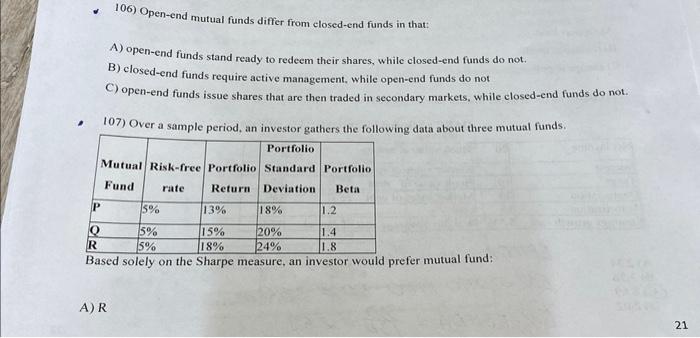

106) Open-end mutual funds differ from elosed-end funds in that: A) open-end funds stand ready to redeem their shares, while closed-end funds do not. B) closed-end funds require active management, while open-end funds do not C) open-end funds issue shares that are then traded in secondary markets, while closed-end funds do not. 107) Over a sample period, an investor gathers the following data about three mutual funds. Based solely on the Sharpe measure, an investor would prefer mutual fund: 108) If a stock's relative strength ratio increases, the stock is: A) outperforming its benchmark. B) underperforming its benchmark. C) increasing in price. 109) Evelyn Stram, CFA. places a good-till-cancelled limit buy order at $86 for a stock. Stram's order - specifies: A) validity and execution instructions. B) execution and clearing instructions. C) clearing and validity instructions. 110) A stock has been in a downtrend for several days. When its price decreases to near $30, many investors enter orders to buy the stock and the price increases to $31. This is most likely an example of-a: A) support level. B) resistance level. change in polarity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts